Overland Park, Kansas, enters 2026 as a premier destination for those seeking Midwestern charm blended…

🏠 The Complete Guide to Buying a Home in Overland Park, KS

In this version, I have updated all dates to 2026, integrated the Regional Market Comparison recommendation (horizontal silo link), and ensured all internal links are dofollow to maximize the flow of ranking power across your site.

Buying a home in Overland Park in 2026 remains a highly rewarding investment, but the process moves quickly. This guide provides a definitive roadmap for all buyers—from first-timers to seasoned investors—on navigating the entire process, from securing financing to closing the deal in today’s market.

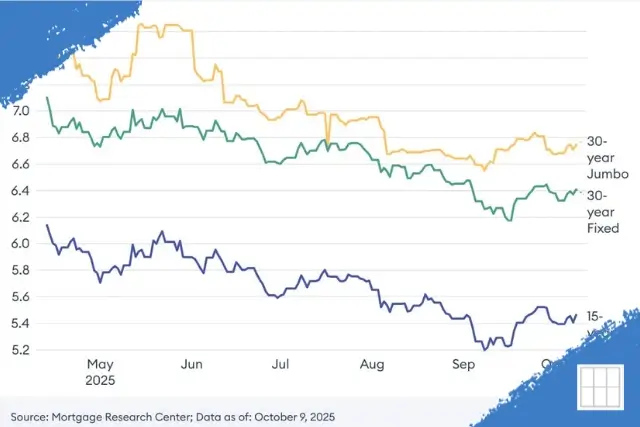

Pro Tip: Financing requirements and property tax structures can vary significantly between Johnson County and the Missouri side of the metro. If you are comparing locations, be sure to review the current Kansas City mortgage rates to see how they impact your purchasing power across the state line.

At Metropolitan Mortgage, we combine our local expertise with faster closing times to ensure your offer stands out in this competitive 2026 Johnson County market.

1. Getting Your Finances in Order (Step 1: The Lender)

Before you start looking at homes, you must know exactly how much house you can comfortably afford and which loan program best suits your 2026 financial profile.

The Financial Checklist for Every Buyer:

-

Determine Your Budget: Use our Affordability Calculator to understand how your income, debts, and down payment affect your maximum purchase price.

-

Check Your Credit: Review your credit score (FICO) and address any inaccuracies. Your score directly dictates the mortgage rate you will receive.

-

Choose the Right Loan: While FHA and VA loans are popular, Conventional Loans (including Jumbo loans for high-value homes) are often the fastest option for qualified buyers in Overland Park. For specialized financial assistance, see our detailed guide on First-Time Buyer Programs in Overland Park.

🔑 Get Pre-Approved: Your Competitive Edge

A pre-approval is mandatory in Overland Park’s competitive environment. Our same-day pre-approval process provides a lender-backed commitment, showing sellers and agents that you are serious and ready to close quickly in 2026.

2. Working with a Local Real Estate Agent

In a fast-moving market like Johnson County, your agent is your greatest asset.

-

Find a Local Specialist: Choose a Realtor who specializes in Johnson County neighborhoods and understands the specific nuances of HOAs, property tax rates, and school district boundaries (especially Blue Valley and Shawnee Mission).

-

Set Clear Criteria: Define your non-negotiables: size, commute time, school ratings, and proximity to amenities. Knowing exactly what you want helps your agent find listings before they hit the general market.

-

Target the Right Area: Overland Park offers incredible diversity. For details on price ranges, school scores, and community vibe, consult our guide to the Best Neighborhoods in Overland Park.

3. The Search, Offer, and Negotiation

Once you are pre-approved and have a great agent, the active phase of buying begins.

-

Know the Market: Overland Park homes often go pending in less than two weeks. While this page provides general context, always review our latest Overland Park Housing Market data for 2026 inventory and pricing trends before making an offer.

-

The Power of a Strong Offer: Your pre-approval provides the foundation. In negotiation, leverage non-monetary terms, such as a flexible closing date or waiving certain contingencies (if advised by your agent).

-

The Inspection: Once an offer is accepted, the inspection period begins. This is your chance to uncover any major issues. If negotiating repairs, rely on your agent’s experience with local contractors and typical Overland Park repair expectations.

4. Finalizing Your Loan and Appraisal

This phase is where your mortgage lender becomes your primary partner.

-

The Appraisal: The lender orders an appraisal to verify that the home’s value justifies the loan amount. If the appraisal comes in low, your lender can help you explore options, but this is less common in appreciating markets like Overland Park.

-

Loan Underwriting: Our team manages the underwriting process entirely in-house in Overland Park. We review all your documentation, title work, and the appraisal to move your loan to final approval.

-

Final Pre-Closing Checklist: Your lender will provide a list of final items, often including proof of hazard insurance and a final walkthrough of the property.

5. Closing Day and Getting the Keys

Congratulations! After weeks of preparation, the 2026 closing day is the finish line.

-

The Closing Disclosure (CD): You will receive your CD at least three business days before closing. This document details all final loan terms, closing costs, and payments. Review it carefully.

-

Closing Costs: These typically range from 2% to 5% of the loan amount. Your closing costs include lender fees, title insurance, and pre-paid items (like property taxes and homeowners insurance).

-

Sign and Fund: At the title company, you will sign the final loan papers. Once the loan is funded, the seller is paid, the deed is recorded, and the keys are officially yours!

The Overland Park homebuying process is streamlined when you partner with local experts. Our team ensures your financing is fast, competitive, and tailored to the unique demands of 2026 Johnson County real estate.

Speak to a local expert today to secure your pre-approval and begin the process. For customized rates, program details, and direct contact with our team, find your home loans near me.

📍 Visit Our Local Overland Park Office

Navigating the Johnson County market is easier when you partner with a local team that understands every neighborhood from Lionsgate to Downtown OP.