Buying a home is a significant milestone, but one of the most common questions potential…

Is It Better to Buy or Rent in Kansas City in 2026?

The question of whether to buy a home or continue renting is one of the most significant financial decisions many people face. In 2026, with interest rates stabilizing and home values appreciating at a more sustainable pace, this decision has new nuances.

While there’s no universal “right” answer, here’s a breakdown of key factors to consider, designed to help you make an informed choice for your specific situation.

1. Understanding the 2026 Market Dynamics

The housing market in 2026 is characterized by:

-

Stabilizing Interest Rates: After the volatility of previous years, 30-year fixed mortgage rates are expected to hover around 6.3%. This makes monthly payments more predictable than in recent past years. Use our Mortgage Payment Calculator to see how different rates impact your budget.

-

Moderate Home Price Growth: Experts predict home prices will continue to rise, but at a more normalized rate of 3-4% annually, rather than the double-digit surges seen previously. This means less immediate equity gains but more stable long-term growth.

-

Tight Inventory: While improving, housing supply in many areas remains below pre-pandemic levels, contributing to continued competition among buyers.

-

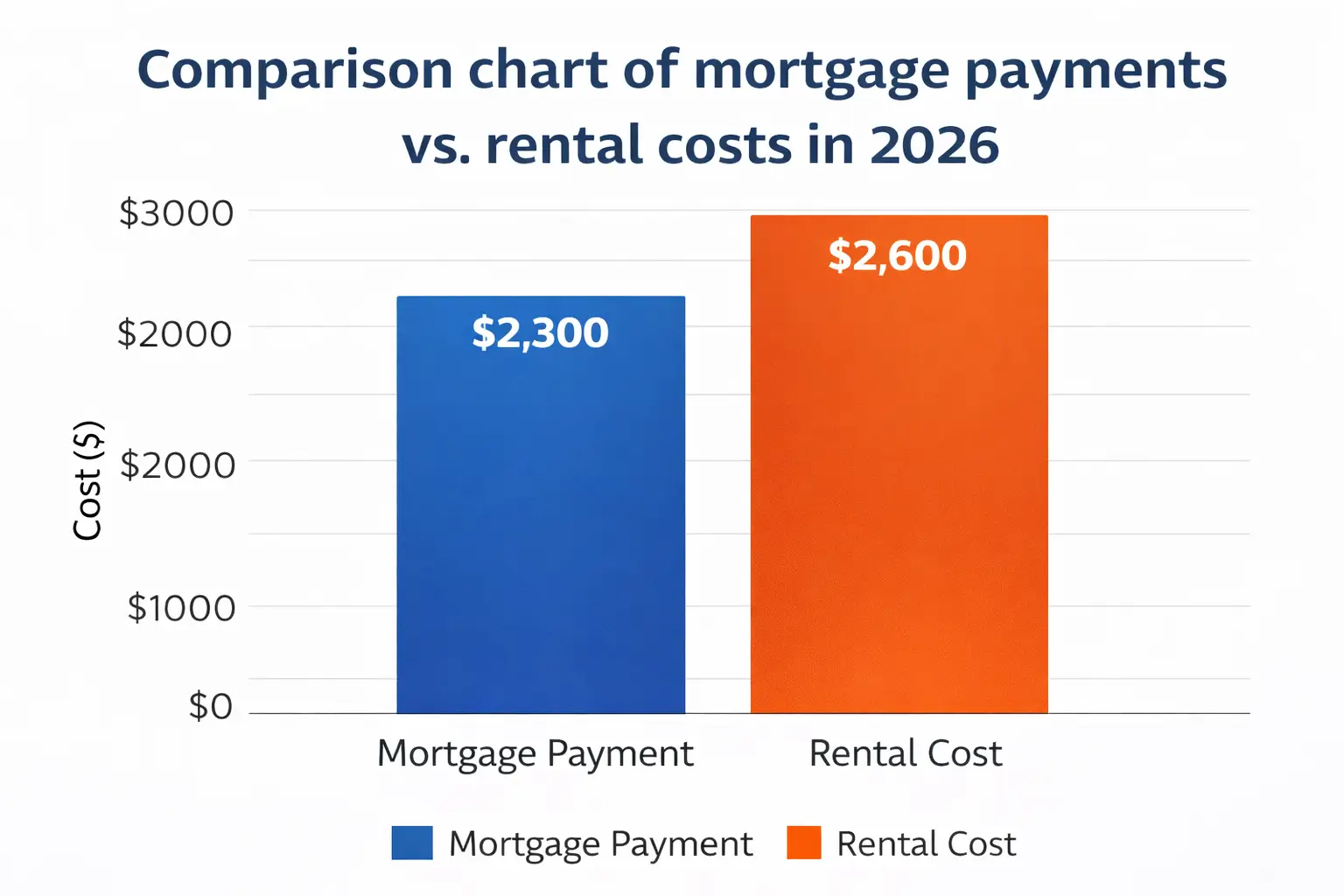

Rising Rents: Rental costs are still climbing in most major metropolitan areas, making homeownership comparatively more attractive for long-term residents.

2. The Case for Buying in 2026

Purchasing a home offers several compelling advantages, especially in a stabilizing market:

-

Building Equity: Your monthly mortgage payments contribute to your personal wealth. As you pay down your loan and the property value increases, your equity grows.

-

Fixed Housing Costs (Mostly): A fixed-rate mortgage locks in your principal and interest payments for the life of the loan, protecting you from rising rental prices. While property taxes and insurance can increase, the largest portion of your housing cost remains stable.

-

Tax Benefits: Homeowners can often deduct mortgage interest and property taxes, potentially lowering their taxable income. (Always consult a tax professional for personalized advice).

-

Personalization & Stability: Owning a home provides the freedom to renovate and personalize your space, and offers a sense of permanence often absent in rental situations.

-

Inflation Hedge: Real estate has historically served as a strong hedge against inflation, as property values and rents tend to rise with inflation.

3. The Case for Renting in 2026

Renting offers its own set of benefits, particularly for those whose life circumstances align with flexibility:

-

Flexibility & Mobility: If your job requires frequent relocation or you’re unsure about your long-term plans, renting allows you to move without the complexities and costs of selling a home.

-

Predictable Monthly Expenses: Beyond rent, your primary housing costs are usually utilities. You’re not responsible for property taxes, homeowners insurance, or unexpected repair costs.

-

Lower Upfront Costs: Renting typically only requires a security deposit and the first month’s rent, significantly less than the down payment and closing costs required for a home purchase. Explore what to expect on our Closing Costs Breakdown page.

-

No Maintenance Worries: Landlords handle all repairs and maintenance, from a leaky faucet to a broken furnace, saving you time, money, and stress.

-

Financial Freedom (Initially): Without a large down payment and closing costs, you might have more cash for investments or other financial goals, at least in the short term.

4. The Critical “Tipping Point”: How Long Will You Stay?

One of the most crucial factors in the buy vs. rent decision is how long you plan to stay in the home. Typically, financial experts suggest that if you plan to live in a home for at least 3 to 5 years, buying becomes more financially advantageous. This timeframe allows you to:

-

Build enough equity to offset closing costs incurred when you bought the home.

-

Benefit from potential home appreciation.

-

Avoid the transactional costs associated with buying and selling in quick succession.

Consider your career path, family plans, and personal goals over the next five years. If stability is on the horizon, buying may be the better choice. If uncertainty looms, renting offers valuable flexibility.

5. The Bottom Line: Your Personal Affordability

Before making any decision, you need a clear picture of your financial standing.

-

Determine Your Budget: Use our Affordability Calculator to understand how much you can comfortably spend on a mortgage payment.

-

Get Pre-Approved: This crucial step will tell you exactly how much a lender is willing to loan you, solidifying your budget. Start your Pre-Approval Process with us today.

In 2026, the market is offering a window for calculated homeownership. If your financial situation and long-term plans align with the benefits of buying, now could be an opportune time to transition from renter to owner.

Ready to explore your options? Contact Metropolitan Mortgage to discuss personalized strategies for buying a home in today’s market.