Are Mortgage Rates Going Down in Kansas City?

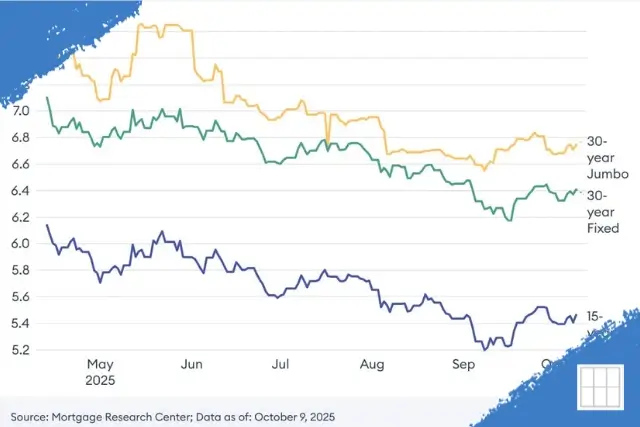

If you’re wondering, “Are mortgage rates going down in Kansas City?” you are entering a pivotal market. As of January 5, 2026, homebuyers and homeowners in the Kansas City metro are seeing a long-awaited shift. Following the Federal Reserve’s three…