Moving to Kansas City in 2026 is a move toward what many call "The Goldilocks…

Should You Buy a Home Now or Wait for Lower Rates?

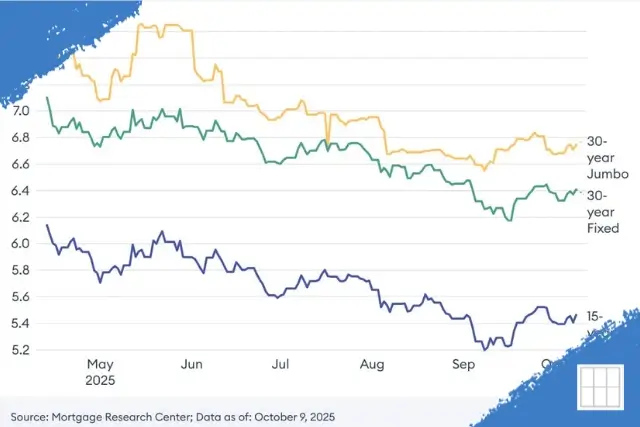

Deciding when to buy a home is a major financial move, and in 2026, timing feels more critical than ever. With mortgage rates beginning their projected “Great Decline” and home prices continuing to climb across Kansas and Missouri, many buyers face a big question: Should I buy a home now or wait for better rates? It’s a tough call, and while no one has a crystal ball, we can break it down with pros, cons, and real 2026 numbers to help you decide.

I’m Rick Woodruff, a Senior Loan Officer (NMLS #248984), and I’ve spent over 25 years helping homeowners navigate these exact market shifts. Whether you’re ready to lock in a rate today or are weighing your options for the spring rush, let’s explore what makes the most sense in today’s market.

Why Buy a Home Now?

There is a compelling argument for entering the market sooner rather than later. Here’s why buying in early 2026 could work in your favor:

- Secure Today’s Prices

Inventory remains tight in many Midwest markets. Buying now locks in your purchase price before the spring competition potentially pushes valuations higher. - Build Equity Faster

Every month you wait is a month of missed principal reduction and appreciation. If home values rise by even 3–5% this year, waiting could cost you five figures in “lost” equity. - The “Refinance Strategy”

If you buy now and rates continue to drop as forecasted, you can refinance into a lower rate later. You win by getting the lower house price now AND the lower rate later. - Beat the “Rate Drop” Rush

When rates hit certain psychological benchmarks (like 5.5%), sidelined buyers often flood the market. Acting now allows you to avoid the bidding wars that come with lower rates.

Why Wait for Lower Rates?

On the other hand, a “wait and see” approach has its own logic. Here is what you might gain by holding off:

- Lower Monthly Commitment

A drop of just 0.5% in interest can shave over $100 off your monthly payment, depending on your loan size. - Increased Purchasing Power

As rates fall, your debt-to-income (DTI) ratio improves, which might allow you to qualify for a slightly more expensive home or a better neighborhood.

The Numbers: A 2026 Comparison

Let’s look at a realistic scenario. Say you’re eyeing a $400,000 home today with a 30-year fixed mortgage rate at 5.99% (a benchmark rate as of January 2, 2026). If you wait, assume prices rise 5% annually and rates fall slightly. Here’s the math:

| Scenario | Home Price | Interest Rate | Loan Amount (20% Down) | Monthly Payment (P&I) | Total Interest Paid (30 Years) |

|---|---|---|---|---|---|

| Buy Now (Jan 2026) | $400,000 | 5.99% | $320,000 | $1,916 | $369,876 |

| Wait 1 Year (Jan 2027) | $420,000 | 5.50% | $336,000 | $1,908 | $350,816 |

| Wait 2 Years (Jan 2028) | $441,000 | 5.00% | $352,800 | $1,894 | $328,958 |

Notes: Assumes 20% down payment. Monthly payment covers Principal and Interest (P&I) only.

2026 Strategy Takeaways:

- The Monthly Gap is Small: Waiting one year to get a 5.5% rate only saves you $8 per month because the higher home price ($420k) requires a larger loan.

- The Cost of Waiting: If you wait two years, the house costs you $41,000 more. Even at a 5.0% rate, your loan balance is significantly higher than if you had bought today.

- The “Double Win”: If you buy today at $400,000 and refinance in 2028 when rates hit 5.0%, your payment would drop to roughly **$1,700**—saving you significantly more than if you waited to buy at the higher price.

Beyond the Numbers: The Rent Trap

If you aren’t building equity in a home, you are likely paying someone else’s mortgage. Consider the “Dead Money” factor:

- Renting while you wait for a 1% rate drop could cost you $20,000–$24,000 in rent over 12 months—money that provides zero return on investment.

- When you factor in the $20,000 price jump (from the example above) plus the $20,000 in rent, waiting one year could effectively cost you $40,000.

Final Thoughts: Your 2026 Move

So, should you buy a home now or wait? In the current Kansas and Missouri markets, buying now usually wins for those planning to stay in their home for at least 5 years.

- Buy Now if you want to freeze your purchase price, start building Midwest equity, and use a refinance strategy if rates drop further.

- Wait only if your personal finances (credit score or down payment) aren’t quite ready, or if you expect a specific lifestyle change in the next 12 months.

No two situations are identical. I recommend running your own specific numbers for your neighborhood—whether it’s Wichita, Johnson County, or St. Louis. Your future self will thank you for doing the math today!

Get a Personalized 2026 Strategy

I’m Rick Woodruff, Senior Loan Officer (NMLS #248984), and I’m here to help you determine if today’s current mortgage rates align with your goals. Reach out at (913) 871-5370 or email me at rickw@emetropolitan.com. Let’s get you closer to homeownership!