Buying a home is a significant milestone, but one of the most common questions potential…

How to Boost Your Credit Score Before Buying a House

Buying a house is one of the biggest financial decisions you’ll ever make, and your credit score plays a starring role in that process. As of 2026, with interest rates fluctuating and lenders tightening requirements, a strong credit score can mean the difference between securing a favorable mortgage or facing rejection—or worse, paying thousands more in interest over the life of the loan. According to recent data, the average credit score for home purchase loans hovers around 737, but minimums vary by loan type. For instance, FHA loans might accept scores as low as 580 with a 3.5% down payment, while conventional loans typically require at least 620 to 640. VA and USDA loans often look for 620 or higher, though no strict minimums exist.

Why does this matter? A higher score not only improves approval odds but also unlocks lower mortgage rates and better terms. For example, bumping your score from 620 to 760 could save you over $100,000 on a 30-year mortgage. But boosting your score isn’t an overnight fix—it requires strategy, patience, and consistent habits. In this post, we’ll dive into proven steps to elevate your credit before you start house hunting, drawing from expert advice to help you achieve homeownership dreams.

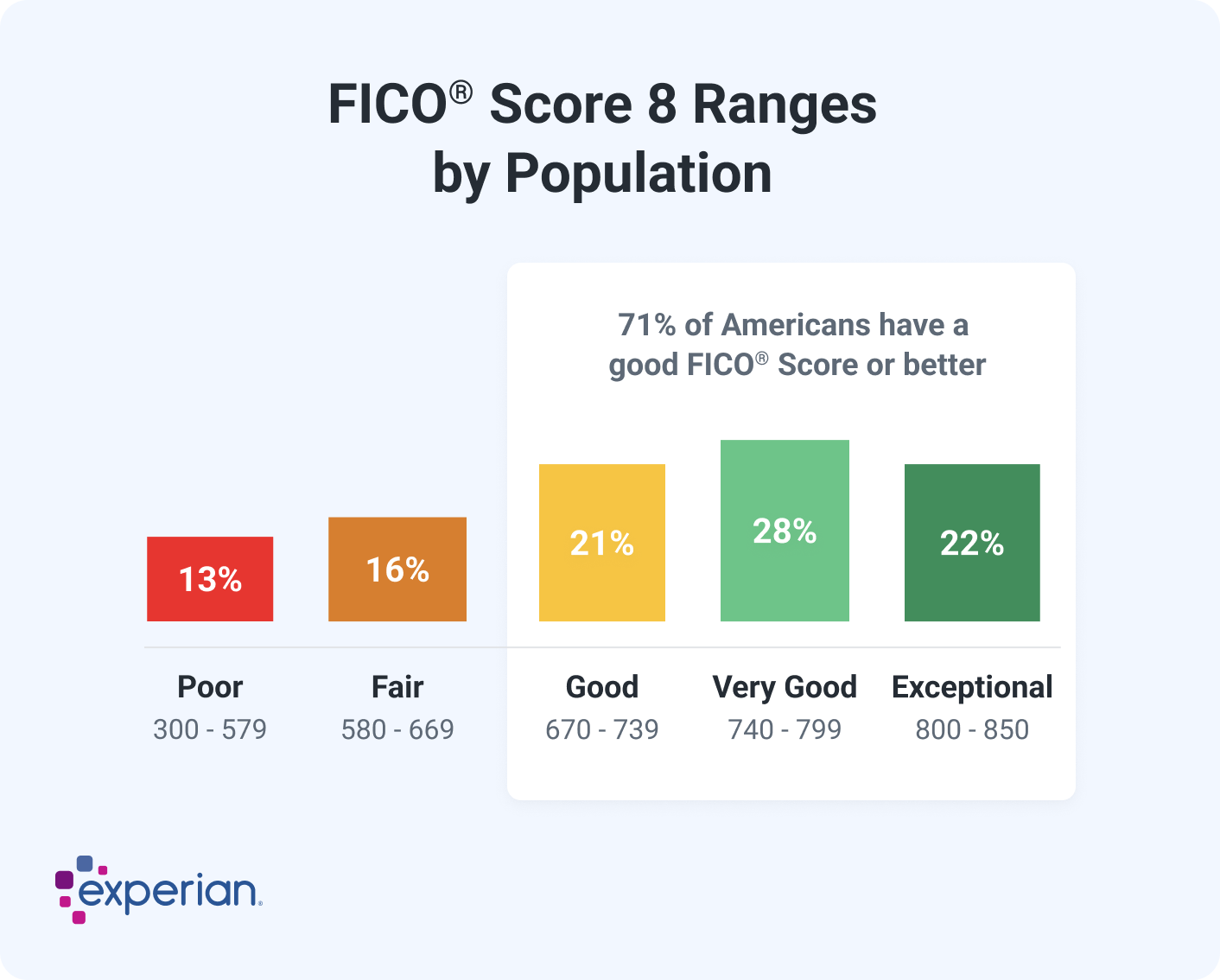

First, understand what a credit score is. It’s a three-digit number, typically ranging from 300 to 850, calculated by models like FICO or VantageScore. Factors include payment history (35% of FICO), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Knowing where you stand is crucial.

experian.com What Is a Good Credit Score?

Step 1: Check Your Credit Reports and Scores

Before anything else, pull your credit reports from the three major bureaus: Equifax, Experian, and TransUnion. You’re entitled to a free weekly report from AnnualCreditReport.com. Scrutinize them for errors—incorrect late payments, outdated information, or fraudulent accounts can drag your score down. Studies show up to 79% of reports contain mistakes, so dispute inaccuracies promptly with the bureaus.

Also, monitor your scores regularly. Tools like Experian Boost can add positive data from utility and phone bills, potentially increasing your FICO score by including on-time payments that aren’t typically reported. Aim to start this process at least six months before applying for a mortgage, as corrections can take 30-60 days.

Step 2: Pay All Bills on Time—Every Time

Payment history is the heavyweight champion of your credit score, accounting for 35% in FICO models. Late payments can linger for seven years, but their impact fades over time. To avoid this pitfall, set up automatic payments for all bills, including credit cards, loans, utilities, and even rent. If you’ve missed a payment recently, contact the creditor immediately—many offer grace periods.

For extra credit (pun intended), consider paying credit cards twice a month to keep balances low throughout the billing cycle. This habit not only prevents late fees but signals reliability to lenders. As one tip suggests, automate everything to free up mental space for other financial goals.

Step 3: Reduce Your Debt and Utilization Ratio

Next, tackle your debt levels. Credit utilization—the ratio of your balances to your credit limits—should stay under 30% for optimal scoring. High utilization screams risk to lenders. Pay down revolving debts like credit cards first, focusing on high-interest ones to save money long-term.

If you’re carrying balances, use windfalls like tax refunds or bonuses to chip away at them. Avoid closing old accounts after paying them off, as this can shorten your credit history and spike utilization. Instead, keep them open and use sparingly.

For those with overwhelming debt, consider working with a nonprofit credit counseling agency. They can negotiate lower rates or set up debt management plans without harming your score further. Improvements here can show up in as little as a month.

Step 4: Avoid New Credit and Build Smartly

In the lead-up to a mortgage application, steer clear of new credit lines. Each application triggers a hard inquiry, which can ding your score by 5-10 points temporarily. If shopping for rates, do it within a two-week window so inquiries count as one.

If your history is thin, build it responsibly. Become an authorized user on a trusted family member’s card with a solid track record—their positive history can boost yours without you using the card. Or, opt for a secured credit card, where your deposit sets the limit, and use it for small purchases paid off monthly.

Diversify your credit mix if needed, but only if it fits your needs—adding an installment loan like a credit-builder loan can help, as mix influences 10% of your score.

Step 5: Request Credit Limit Increases

Once you’ve reduced balances, ask for higher credit limits on existing cards. This lowers your utilization ratio without adding new debt, provided you don’t increase spending. Issuers often approve if you’ve shown responsible use. Note: This might involve a soft inquiry, but it’s worth it for the potential score bump.

Step 6: Handle Collections and Negative Items

If you have debts in collections, address them head-on. Negotiate settlements or pay in full to remove or update the marks. While negatives like bankruptcies stay for 7-10 years, paying them shows progress. Avoid scams promising to erase accurate info—stick to legitimate steps.

For alternative boosts, add rent payments to your report via services like Experian Boost. This can add positive data quickly.

Timeline and Patience: How Long Does It Take?

Boosting your score takes time—quick wins like paying down balances might appear in 30 days, but building history spans months or years. Start 6-12 months before house shopping to allow changes to reflect. Track progress monthly and protect against fraud by using secure practices.

If your score is low due to short history, a side hustle for extra income can accelerate debt payoff. Create a budget to manage expenses and prioritize credit health.

Conclusion

Improving your credit score before buying a house is about smart, sustained actions: checking reports, paying on time, reducing debt, and avoiding pitfalls. With dedication, you can elevate your score, secure better mortgage terms, and step into homeownership confidently. Remember, patience pays off—start today, and consult professionals if needed. Your dream home awaits!