If you're wondering, "Are mortgage rates going down in Kansas City?" you are entering a…

Sedgwick County Housing Market: 2026 Trends, Prices, and Opportunities

As the “Air Capital of the World,” the Wichita housing market is a 2026 stability anchor, frequently recognized for its unmatched affordability and steady economic growth. With thriving communities like Derby, Andover, and Bel Aire, Sedgwick County offers a unique blend of urban industry and suburban comfort. This post explores the latest data, local trends, and essential tips for buyers, sellers, and investors in South Central Kansas.

Ready to Buy in Wichita?

Get a competitive edge in Sedgwick County by knowing your local loan limits and budget. Start with a Wichita mortgage expert.

Key Market Statistics (November 2025)

- Median Home Price: $254,250 in Sedgwick County (up 1.3% year-over-year).

- Homes for Sale: 1,061 active listings in Wichita (a 15.6% increase from 2024).

- Days on Market: 31 days on average in the county; 50 days within Wichita city limits.

- Homes Sold: 563 total sales in November, reflecting a stable market despite seasonal shifts.

Price Trends by Area:

- Andover: $320,000+ median (West Wichita/Butler County border).

- Derby (67037): $285,000 median (up 9.6%).

- Bel Aire: $283,000 median (highly competitive).

- South Wichita: $150,000 median (offering high affordability).

Market Trends

- Measured Price Growth: Unlike more volatile metros, Sedgwick County saw a healthy 1.3% rise. Wichita remains one of the most affordable large cities in the U.S.

- Increasing Inventory: Wichita’s active listings rose over 15%, giving buyers more options than they had during the hyper-competitive 2023–2024 period.

- Fast-Moving Suburbs: While the city average is 50 days, homes in high-demand pockets like Derby and Maize are selling much faster, signaling a strong seller’s advantage in top school districts.

- Medium-Term Rental Shift: A surge in “traveling professional” housing—driven by aerospace and healthcare—is creating new opportunities for Wichita landlords.

Factors Driving the Wichita Housing Market

Several key factors define the 2026 Sedgwick County outlook:

- Aerospace & Industrial Strength: A steady 3.8% unemployment rate is supported by industry heavyweights like Spirit AeroSystems, Textron Aviation, and Koch Industries.

- Education Rankings: According to 2026 Niche rankings, Valley Center Public Schools (USD 262) is the #1 best school district in Sedgwick County, followed closely by Maize USD 266.

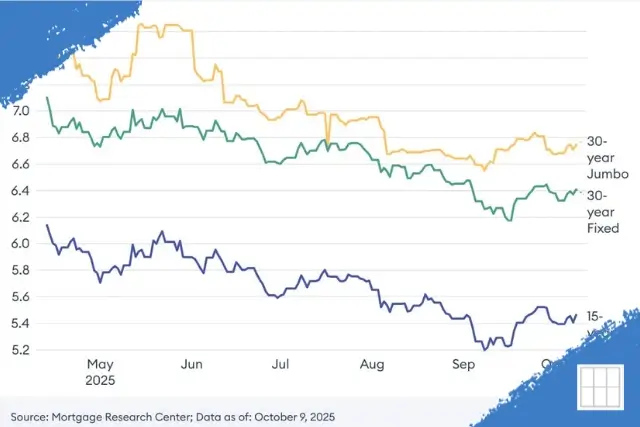

- Interest Rates: As of early January 2026, Kansas 30-year fixed rates are averaging around 5.99%. Check current Wichita mortgage rates for personalized quotes.

- New Construction Value: New builds in Goddard and Maize are priced competitively against older resales, drawing buyers toward fresh inventory.

Tips for Buyers, Sellers, and Investors

Home Buyers

- Leverage VA/FHA: Wichita’s price points are ideal for low-down-payment programs. Explore Kansas first-time homebuyer resources.

- County-Specific Limits: The 2026 Conforming Loan Limit for Sedgwick County is $832,750.

- Look to the Outskirts: Communities like Valley Center and Kechi offer lower land costs and robust new development.

Home Sellers

- Highlight Economic Proximity: Emphasize commute times to major healthcare hubs or the aerospace corridor (I-135 and K-96 access).

- Price for Stability: Appraisals in Wichita are steady; use our home valuation tool to set a realistic price based on local comps.

- Focus on Mechanicals: Local buyers prioritize HVAC and roof health due to regional Kansas weather patterns.

For Investors

- Target Multi-Family: Wichita duplexes offer some of the best “price-to-rent” ratios in the Midwest.

- Traveling Professional Housing: Furnished rentals for traveling nurses and aerospace contractors are currently yielding higher returns than standard leases.

- BRRRR Strategy: High affordability makes South and West Wichita prime locations for the Buy, Rehab, Rent, Refinance, Repeat model.

Looking Ahead: Wichita Housing Market in 2026

The Wichita market enters 2026 with more balance than it has seen in years. Wichita State University forecasts suggest that while new construction starts may flatten, the existing home market will remain active as rates stabilize. To secure your financing in one of the nation’s most resilient markets, connect with our Wichita Mortgage Team today.