If you're wondering, "Are mortgage rates going down in Kansas City?" you are entering a…

Shawnee County Housing Market: 2026 Trends, Prices, and Opportunities

As the seat of Kansas government, the Shawnee County housing market remains a primary destination for those seeking a balance of stable public-sector employment and exceptional Midwest affordability. Anchored by Topeka, this market is increasingly attractive to first-time buyers and remote workers who prioritize a lower cost of living without sacrificing urban amenities. This report dives into the latest trends and data shaping the 2026 outlook for Shawnee County.

Planning a Move to Topeka?

Shawnee County offers unique financing opportunities, including specialized programs for state employees and first-time buyers. Start your journey with a local expert.

Key Market Statistics (November 2025)

- Median Home Price: $223,950 in Shawnee County (up 6.7% year-over-year).

- Active Inventory: 553 units in the Sunflower MLS (an 18% increase compared to 2024).

- Days on Market: 23 days on average, reflecting a highly competitive environment for well-priced homes.

- Monthly Sales: 164 homes sold in November, maintaining steady volume despite seasonal shifts.

Price Trends by Zip Code:

- West Topeka (66610): $383,000 median (trending upward 3.7%).

- College Hill: $220,000 median (popular for historic architecture).

- Central Topeka: $149,900 median (ideal for investment and entry-level buyers).

- Oakland/North Topeka: $99,000 median (the county’s most affordable entry point).

Market Trends

- Government-Backed Stability: The heavy concentration of state government and healthcare jobs (Stormont Vail, St. Francis) provides a stable floor for Shawnee County property values.

- Inventory Recovery: While still a seller’s market with 1.8 months of supply, the 18% jump in active listings is giving Topeka buyers the most leverage they have seen in three years.

- The “Westward Expansion”: Demand remains highest in the Auburn-Washburn School District (West Topeka), currently ranked as the #1 school district in Shawnee County.

- Historic Revival: Neighborhoods like Potwin and College Hill are seeing increased renovation activity as buyers seek character at lower price points than the KC metro.

Factors Driving the Shawnee County Housing Market

Several economic levers are influencing Topeka’s real estate trajectory for 2026:

- Job Market Strength: Major employers like BNSF Railway, Blue Cross Blue Shield, and Mars Wrigley support a 3.9% unemployment rate.

- National Affordability Rankings: Topeka consistently ranks in the top 10 “Emerging Housing Markets” due to its low entry price compared to national averages.

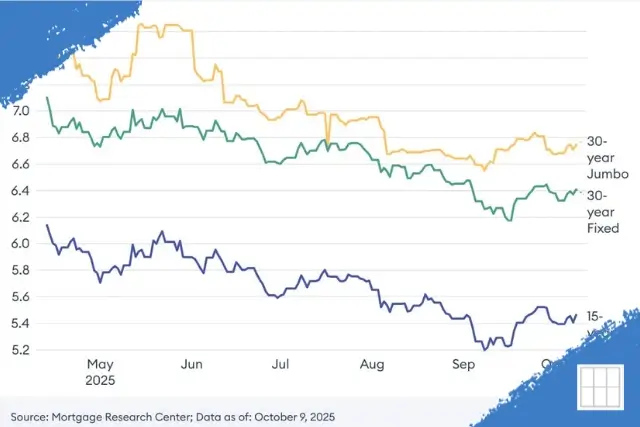

- Interest Rate Impact: As of early January 2026, Kansas 30-year fixed rates are averaging around 6.04%. Check current mortgage rates to plan your purchase.

Tips for Buyers, Sellers, and Investors

Home Buyers

- Look for Seller Concessions: With inventory rising, more Topeka sellers are willing to cover closing costs or buy down interest rates.

- Loan Limits: The 2026 Conforming Loan Limit for Shawnee County is $832,750, offering plenty of headroom for local buyers.

- First-Time Programs: Explore the Kansas First-Time Homebuyer Program for down payment assistance.

Home Sellers

- Price Strategically: If a home in Topeka doesn’t sell within 25 days, it risks becoming “stale.” Use a local valuation tool to hit the market “sweet spot.”

- Focus on Curb Appeal: First impressions in Westboro or Sherwood Estates are critical for securing multiple offers in a normalizing market.

- Stage Well: Check staging tips on HGTV to maximize appeal.

For Investors

- High Rental Yields: Average rent has risen to $1,137. Central Topeka acquisition costs allow for some of the best cash-on-cash returns in the state.

- Stability: Target neighborhoods near the State Capitol or major hospitals to attract long-term, public-sector tenants.

- Professional Management: Partner with local experts to implement BRRRR strategies in this high-yield market.

Looking Ahead: Shawnee County in 2026

The 2026 outlook is one of “healthy normalization.” While we don’t expect the extreme appreciation of previous years, a 2-3% annual growth is likely. To explore your options in the Topeka metro or get a custom rate quote, reach out to our Kansas Mortgage Team today.