If you're wondering, "Are mortgage rates going down in Kansas City?" you are entering a…

Jackson County Housing Market Update for 2026

Located in the heart of the Kansas City metro, Jackson County, Missouri, offers a vibrant mix of urban and suburban living, with strong economic drivers and diverse housing options. For buyers, sellers, or investors, understanding 2025 trends is key. This post explores market data, driving factors, and practical tips.

Buying a Home in Jackson County?

The Jackson County market is competitive (42 days on market). Get pre-approved to strengthen your offer in Kansas City, Independence, and Lee’s Summit.

A Snapshot of Jackson County’s Housing Market in 2025

Covering areas like Kansas City, Independence, and Lee’s Summit, Jackson County provides homes ranging from affordable starters to high-end properties. The market remains seller-friendly due to steady demand, though it is moving at a slightly more balanced pace than last year.

Key Market Statistics (November 2025)

- Median Home Price: $280,000 (up 3.7% year-over-year).

- Homes Sold: 700 homes in November (down 14.6% YoY).

- Days on Market: 42 days (compared to 39 days last year).

- Inventory: 2,276 homes for sale (up 5.9%).

The median sale price per square foot reached $155, showing continued, moderate appreciation across the county.

Market Trends

- Sustainable Growth: A $280,000 median price reflects moderate 3.7% growth. Appreciation is strongest in entry-level homes, making them the most competitive segment.

- Market Pace: While homes sell roughly 3 days slower than last year, a 42-day average still firmly favors sellers.

- Regional Variation: Suburbs like Lee’s Summit ($479.9K median) command higher premiums compared to the broader county median.

- Inventory Recovery: A 5.9% increase in active listings is providing more choices for buyers than in previous seasons.

Factors Driving the Jackson County Housing Market

Jackson County is the second-largest economic engine in Missouri, shaped by several key factors:

- Economic Strength: Major employers in healthcare (Children’s Mercy, Saint Luke’s) and finance (Hallmark, H&R Block) provide high job stability.

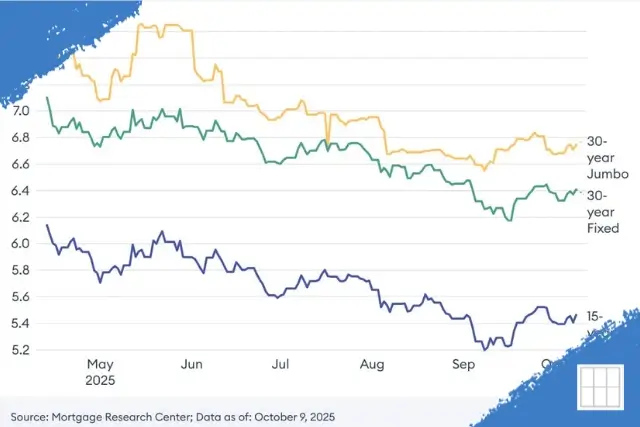

- Interest Rates: Rates average near 6.26%. For the most competitive terms, connect with our Jackson County home loan experts.

- New Construction: Residential growth in Lee’s Summit is helping to meet the long-term demand for modern housing.

- Quality of Life: Access to diverse urban amenities and suburban school districts (like Lee’s Summit R-7) keep demand high.

Tips for Buyers, Sellers, and Investors

Home Buyers

- Act Swiftly: To win in Lee’s Summit or Kansas City, get pre-approved and be ready to submit strong offers.

- First-Time Buyer Programs: Explore MHDC’s First Place and Next Step programs for down payment assistance. Check Missouri first-time homebuyer options.

- Value Segments: Consider Independence or Raytown for homes priced below the county median.

Home Sellers

- Price Strategically: Selective buyers are looking for value. Use local comps to avoid overpricing.

- Highlight Local Demand: Emphasize proximity to major employment hubs or high-ranking school districts.

- Professional Staging: Check staging tips from HGTV to stand out in a growing inventory market.

For Investors

- High Rental Demand: Stable job markets in Kansas City and Lee’s Summit ensure low vacancy rates for rental properties.

- BRRRR Strategy: Independence offers the best entry points for “Buy, Rehab, Rent, Refinance, Repeat” strategies. Consult with Jackson County property managers for local insights.

Looking Ahead: Jackson County Housing Market in 2026

Jackson County’s market is forecast to see price growth in the 3–5% range for 2026. While inventory is slowly increasing, the market remains seller-friendly. To navigate this landscape, connect with local Jackson County mortgage lenders today.