If you’re like most people in Olathe, you’ve probably been putting off buying a home. That’s likely because of the rapidly increasing cost of single-family homes. Unless you find adequate mortgage lending and refinancing options in Olathe, you’ll be stuck where you are.

The average two-story, four-bedroom home can cost an upward of $500,000. What’s more, good credit scores and solid income aren’t sufficient enough to qualify for financing anymore; now lenders require down payments as high as 20% or more.

And all of this is in spite of the fact that we are experiencing a steady decline in the rate of inflation. If this trend continues, people who can’t afford a home will lose the choice to buy homes even if they’d like to own one someday.

Olathe Home Loans Financing

At Metropolitan Mortgage Corporation, we’re committed to being the best Olathe mortgage lenders. We will work tirelessly to come up with the mortgage product that meets your individual needs.

Conventional Loans

Traditional or conventional loans usually have a fixed amount of money at the outset and must remain at that level for as long as you’re making payments to the bank on time. Unless something goes terribly wrong in the economy, these loans generally stay flat indefinitely.

A conventional loan generally requires a down payment of 10% and has a maximum LTV ratio (loan amount divided by appraised value) requirement of 80%, with more depending on whether the client has 20% equity in their home and other factors like a credit score.

Metropolitan Mortgage Corporation allows for a down payment as low as 3%. We also provide fixed and adjustable rates. You can apply for a conventional loan with us and get a mortgage pre-approval in less than a day.

Refinance your Home Loan in Olathe

Refinancing your mortgage can often be the best way to get a home loan. In some cases, people are able to reduce their monthly payments by hundreds of dollars per month. Refinancing also offers additional benefits, like lower and more stable interest rates and better terms for paying off the mortgage early.

Metropolitan Mortgage Corporation can help with the refinancing of your mortgage. The housing market is booming, and mortgage rates are at a historic low. Now maybe a good time to refinance your home loan for a lower interest rate and monthly payment. If you have an FHA or VA loan, you can do this for free (and even get cashback). If you have a conventional mortgage, it’s still worth looking into because of the low rates.

Paying Off Your Mortgage Faster

Paying off your mortgage faster is more than just a financial goal. It’s the ultimate piece of checks and balances in your life as a homeowner. When you pay off your home early, you free up that monthly payment for other purposes. It gives you peace of mind and provides some real financial security to know that no matter what happens in the future, you can keep living in the house that’s been such an important part of your life.

Metropolitan Mortgage Corporation always puts the client first. You can expect the most competitive rates in the country. All our loans are closed in 30 days or less. Contact our Metropolitan Mortgage Corporation location in Overland Park, Kansas, to purchase or refinance a home.

Contact us today!

Contact Metropolitan Mortgage Corporation in Overland Park, Kansas, to purchase or refinance a home.

Apply Online >

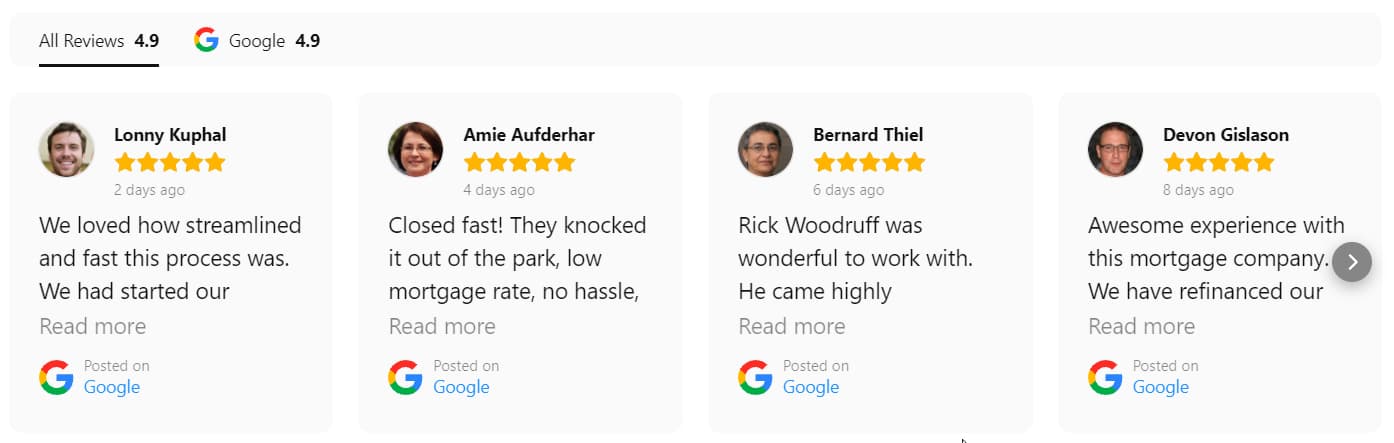

CHECK OUT OUR RATINGS

Don’t just take our word for it. A significant portion of our Olathe, KS business comes from referrals–check our ratings! Along with the realtor, title company, and insurance agents, we provide every client the highest level of customer service. So, here are some client reviews on their Loan Officer.

Serving Nearby Cities:

Gardner, KS | Lawrence, KS | Leawood, KS | Lenexa, KS | Overland Park, KS | Shawnee, KS | Topeka, KS