Living in Gardner, KS, places you at the crossroads between different mid-western states. There is plenty of rural land in the Great Plains, ready for you to explore and settle. The Gardner housing market is strong and offers a great investment opportunity.

Metropolitan Mortgage Corporation is proud to provide the local community with mortgages that allow more families to fund their dream homes. As one of the top Gardner mortgage lenders, they may offer you various mortgage products, each one suitable for different parts of the population.

VA Mortgages

They apply to veterans who were on active duty in the Army or the National Guard. There is no requirement for a downpayment, and you can have up to $500,000 from your Gardner mortgage lenders to buy your dream house. Interest rates are lower than the average and government-subsidized to allow veterans (or widows) to buy a house and shelter their families. There is also the chance to refinance that mortgage in case you face sudden financial hardships.

USDA Home Loans

This Gardner mortgage plan applies to people who have the right credit score and wish to buy a house in certain rural locations. The government subsidizes the interest rates, which helps to lower the payment amounts. You can choose between a fixed or variable interest rate mortgage. There is a chance you get approved for the mortgage even when your credit score is as low as 640. 30 and 15 year fixed rates are also available for that category of mortgage owners.

Vacation Homes Loans

Even when you already own a house, you would like to buy a second one to serve your vacation purposes. You typically need a 3% down payment, and you may choose between 15 and 30-year fixed rates for paying it back. Maintaining a good credit score and using it as a second house without a yearly rental contract to third parties will enable you to have such a vacation home mortgage.

Jumbo Loans

Many people would like to give a higher down payment (close to 20% of the home value) and ask for a larger mortgage. The law allows financial institutions to issue mortgages up to $3 million for people who want to commit to buying an expensive property. Since the risk is higher for the institutions, you typically agree to pay an elevated interest rate. There are still options for 15 or 30 years fixed interest rates, while you may also choose the variable rates.

FHA Loans

If you don’t own a house and meet certain low-income eligibility criteria, you can apply for FHA loans. You may qualify if you have an average credit score and be required to finance almost 97% of the actual home value. There is a requirement to deposit a 3% down payment that is easy to have, especially when choosing houses in rural locations. As Garder mortgage brokers, we are proud to offer such products to the community.

Conventional Loan

People who have no eligibility criteria for other benefits can apply for conventional loans. You will need the highest credit score you can have to apply. Being the best mortgage broker in Gardner, we can offer you lower interest rates and lower down payment requirements.

Why You Should Choose Metropolitan Mortgage Corporation

Metropolitan Mortgage Corporation has been committed to providing customers with a one-stop, full-service mortgage banking experience for over 30 years. With competitive rates, flexible programs, and knowledgeable associates, we can help you find the best solution to your home financing needs.

Contact us today!

Contact Metropolitan Mortgage Corporation in Overland Park, Kansas, to purchase or refinance a home.

Apply Online >

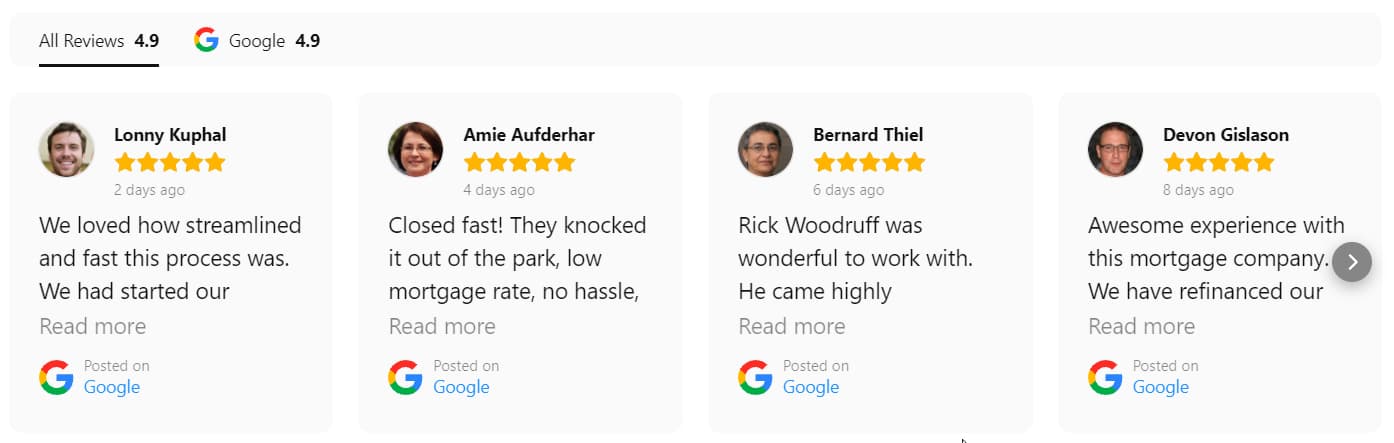

CHECK OUT OUR RATINGS

Don’t just take our word for it. A significant portion of our Leawood, KS business comes from referrals–check our ratings! Along with the realtor, title company, and insurance agents, we provide every client the highest level of customer service. So, here are some client reviews on their Loan Officer.

Serving Nearby Cities:

Lawrence, KS | Leawood, KS | Lenexa, KS | Olathe, KS | Overland Park, KS | Shawnee, KS | Topeka, KS