Topeka is in Shawnee County and is one of the best places to live in Kansas. Living in Topeka offers residents a dense suburban feel and most residents own their homes. In Topeka there are a lot of coffee shops and parks. The public schools in Topeka are above average.

Topeka Mortgage Lenders – Metropolitan Mortgage

Metropolitan Mortgage Corporation has been helping families and individuals in Topeka, Kansas, for over 20 years. As a homebuyer, you can be sure of getting the best loans that suit your situation and requirements with our company. If you are looking to get a home loan in Topeka, KS you have come to the right place.

Our team of experienced professionals will guide you through the entire home buying process and help you overcome any challenges you may face along the way. Our locally owned and operated company values integrity, honesty, and top-quality service.

Our team works hard to make your entire home loan process in Topeka as simple as possible. We will help you identify the best financing based on your current financial situation and the type of home you are planning to buy. We provide a wide range of lending options to all our customers in Topeka. Whether you are a first-time buyer or an experienced homeowner, our team will help you find the best mortgage rates on your property.

Lender Services We Offer

Conventional Loans

Conventional loans are the most common type of financing. Our team at Metropolitan Mortgage helps you understand the minimum down payment, interest rates, and qualifications required. In addition, they explain the pros and cons of conventional loans and help you determine if this is the right kind of loan for you.

FHA Loans

FHA loans are insured by the Federal Housing Administration (FHA). They help low to moderate-income individuals who cannot make large down payments for their homes. Our team helps you understand the benefits of FHA loans and guides you through the minimum down payment requirements monthly. We also let you know about the loan’s qualifying and minimum credit score requirements.

VA Home Loans

Backed by the Department of Veteran Affairs, VHA home loans can be given only to military personnel and veterans. If you are an active or retired military personnel, our team speaks to you and guides you through the VHA home loan process. We tell you about the benefits of these home loans, maximum loan limits, and interest rates so that you can make an informed decision.

USDA Home Loan

Offered by the USDA Rural Development Loan Program, these loans are only for low and moderate-income families who live in eligible rural areas. Our team of professionals gives you information about USDA home loans, eligibility requirements, minimum credit score requirements, and maximum loan amounts that you can get.

Jumbo Loans

Eligible for larger-priced homes, Jumbo loans require good credit scores and larger down payments. As Topeka, KS mortgage lender, Metropolitan Mortgage Corporation will inform you about the benefits of jumbo loans, the minimum down payment requirements, loan limits, and interest rates.

Vacation Homes

Our team of professionals helps you find the right loan to buy a second home or investment property. We inform you about the different types of vacation home loans and how you can get qualified. We guide you through the pre-qualification process and help you find real estate agents in your area who can help you finalize your property.

30 Year Fixed

30 year fixed loans are ideal for people who plan to stay in the same home long-term. These loans give individuals the stability of consistent payments. They have low-interest rates and consistent payments. As a result, individuals can plan their budgets with ease. Our team guides you through the process of applying for 30 year fixed loans, explains to you how these loans work, and informs you about the qualifications required.

15 Year Fixed

We offer 15 year fixed rate home loans to clients in Topeka. With these loans, you can repay the principal and interest every month through monthly payments. This type of loan is cheaper than most other loan options. Our team explains the benefits of 15 years fixed loans and helps you determine whether this loan type is ideal for you.

Whether you are a first-time homebuyer or have bought homes before, our company will be there to guide you every step of the way. We work hard to ensure all our clients have a hassle-free and great experience with us. We help them find loan options with big savings and a simple application process.

Looking to buy a home?

Contact Metropolitan Mortgage Corporation for your home loan!

Contact us today!

Contact Metropolitan Mortgage Corporation to purchase or refinance a home.

Apply Online >

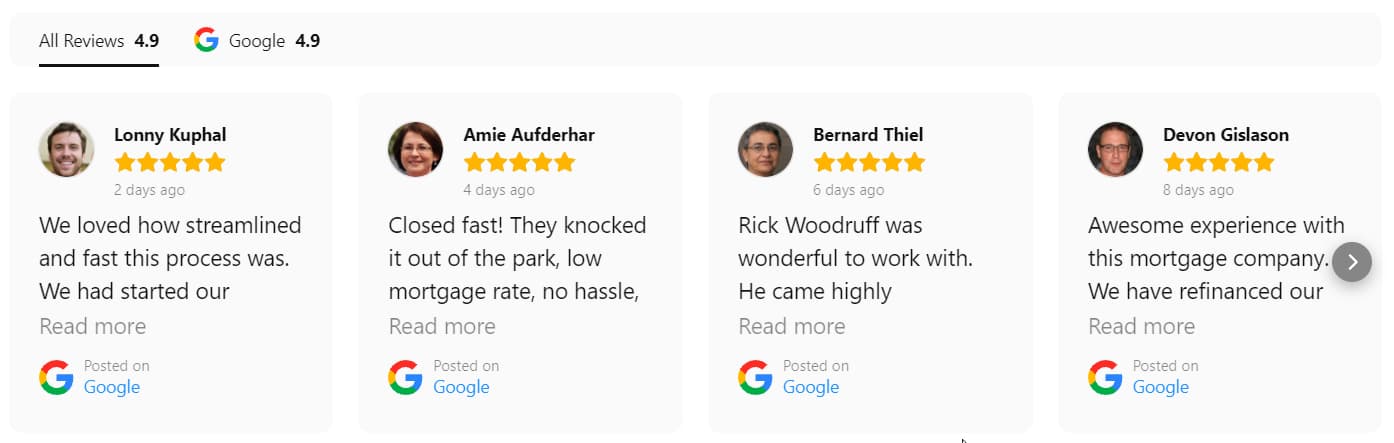

CHECK OUT OUR RATINGS

Don’t just take our word for it. A significant portion of our Topeka, KS business comes from referrals–check our ratings! Along with the realtor, title company, and insurance agents, we provide every client the highest level of customer service. So, here are some client reviews on their Loan Officer.

Serving Nearby Cities:

Gardner, KS | Lawrence, KS | Leawood, KS | Lenexa, KS | Olathe, KS | Overland Park, KS | Shawnee, KS