Welcome To Metropolitan Mortgage – A Mortgage Lender In Sedalia, MO.

We are Sedalia mortgage lenders that offers low rates making us one of the best mortgage lenders in the area.

Buying a home will probably be one of the most expensive purchases you make in your lifetime. Our team will help you with your loan and mortgage process every step of the way. As a trusted lender in Sedalia, we understand your specific needs and help you based on your situation. We have reached where we are today in Sedalia due to our top-quality service and customer-first approach. Our main goal is to provide all our clients the best mortgage rates every month. Our unique loan application process provides you with a stress-free experience. Our experienced loan officers guide you to the best loan option and loan terms based on your requirements.

Mortgage Lending Services in Sedalia, MO.

New Home Purchases

We help clients with their new home purchases. We offer a wide range of loan options that individuals can explore based on their requirements and needs.

Mortgage Refinance

We advise clients on their mortgage refinance options. We help them reduce monthly payments, shorten their mortgage term, and streamline the options available to them.

FHA Home Loans

These home loans are ideal for first-time homebuyers. They require low down payments and are easy to qualify for. Our team helps you understand whether FHA loans are ideal for you and if you qualify for them.

Conventional Home Loans

These home loans are ideal for first-time homebuyers, 2nd homes, or investment properties. They provide up to 97% financing, have lower interest rates, but need a higher credit score to qualify an individual.

Our team can work with you to guide you through the conventional loan application process and help you understand the requirements for this loan type.

VA Home Loans

These home loans are given only to active and retired military personnel. They offer 100% financing, require zero down payments, and require a minimum credit score. If you are an active-duty military officer or a veteran, speak to our team about qualifying for a VA home loan.

USDA Home Loans

USDA Home Loans offer 100% financing for rural properties. They are ideal for low and moderate-income households from eligible rural areas. They don’t require a very high credit score and don’t need individuals to pay a down payment. Our team of loan officers helps individuals determine whether they qualify for USDA home loans and guide them through the entire application process.

Jumbo Loans

Jumbo loans are usually given for high-priced homes. They need a sizeable down payment and a high credit score for qualification. Usually, the minimum down payment for Jumbo loans is 20% of the property’s purchase price. If you are looking to apply for a Jumbo home loan, contact our team. We will help you determine whether you qualify for the loan and advise you on applying for them.

30 Year Fixed Home Loan

These home loans are ideal for anyone purchasing a home to stay in it for the long term. These types of home loans give individuals the stability of a consistent interest rate and payment plan. Our team will speak to you and guide you on applying for a 30 year fixed home loan. We will answer all your questions and inform you whether you qualify for this loan type or not.

15 Year Fixed Home Loan

15 year fixed home loans let you repay the principal and interest every month. And since these loan types have a fixed-rate mortgage, the interest rate will remain the same throughout the loan tenure. Speak to our team of mortgage specialists if you need more information about 15 year fixed home loans. Our team will help you determine if you qualify for this loan type and guide you through the entire process.

- Pre-Approval: Find out today how you can get started on your pre-approval.

- Mortgage Refinance: Lower your monthly payments or reduce your loan terms by speaking to us at Metropolitan Mortgage Corporation in Sedalia

- Mortgage Rates: Get the latest information about mortgage rates years

- Mortgage Calculator: Find out how much mortgage you will have to pay on your loan using our mortgage calculator.

Home Loans and Refinancing in Sedalia

Looking to buy a home in Sedalia?

Contact us today!

Contact Metropolitan Mortgage Corporation in Kansas City, MO to purchase or refinance a home.

Apply Online >

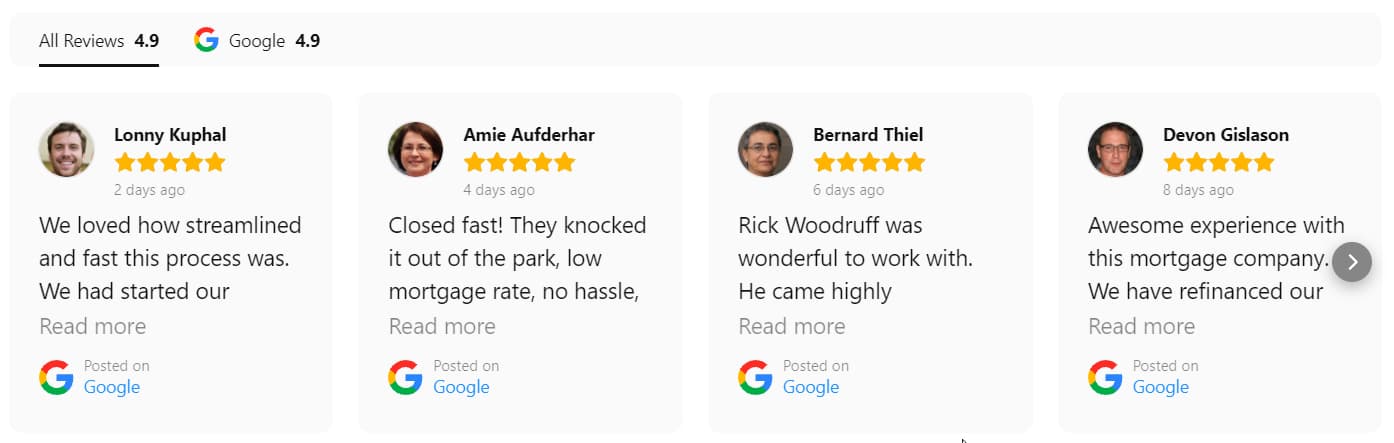

CHECK OUT OUR RATINGS

Don’t just take our word for it. A significant portion of our Sedalia, MO business comes from referrals–check our ratings! Along with the realtor, title company, and insurance agents, we provide every client the highest level of customer service. So, here are some client reviews on their Loan Officer.