Overland Park, Kansas, enters 2026 as a premier destination for those seeking Midwestern charm blended…

Are Mortgage Rates Going Down in Kansas City?

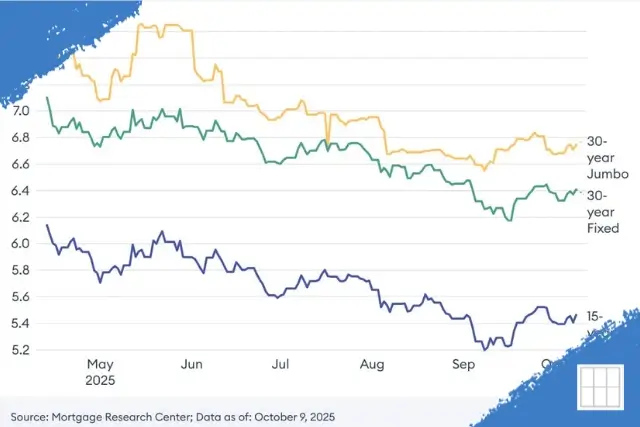

If you’re wondering, “Are mortgage rates going down in Kansas City?” you are entering a pivotal market. As of January 5, 2026, homebuyers and homeowners in the Kansas City metro are seeing a long-awaited shift. Following the Federal Reserve’s three consecutive rate cuts in late 2025, interest rates have finally stabilized in the low-6% range. In this guide, we’ll break down current 2026 data, explore local trends in neighborhoods from Overland Park to Lee’s Summit, and help you decide if now is the time to lock in your rate.

Current Mortgage Rates in Kansas City (January 2026)

Kansas City mortgage rates remain slightly more competitive than the national average, thanks to a robust local lending market. Here is a snapshot of the current averages for the first week of 2026:

| Loan Type | Average Rate | APR | Trend from Q4 2025 |

|---|---|---|---|

| 30-Year Fixed | 6.01% | 6.12% | Down 0.28% |

| 15-Year Fixed | 5.40% | 5.58% | Down 0.10% |

| 5/1 ARM | 5.88% | 6.31% | Downward Drift |

| Jumbo (30-Year) | 6.15% | 6.24% | Steady |

These rates represent a significant improvement from the 7% highs seen in early 2025. For a personalized quote based on your credit score and down payment, visit our live KC mortgage rate table.

Are Mortgage Rates Going Down in Kansas City? The 2026 Outlook

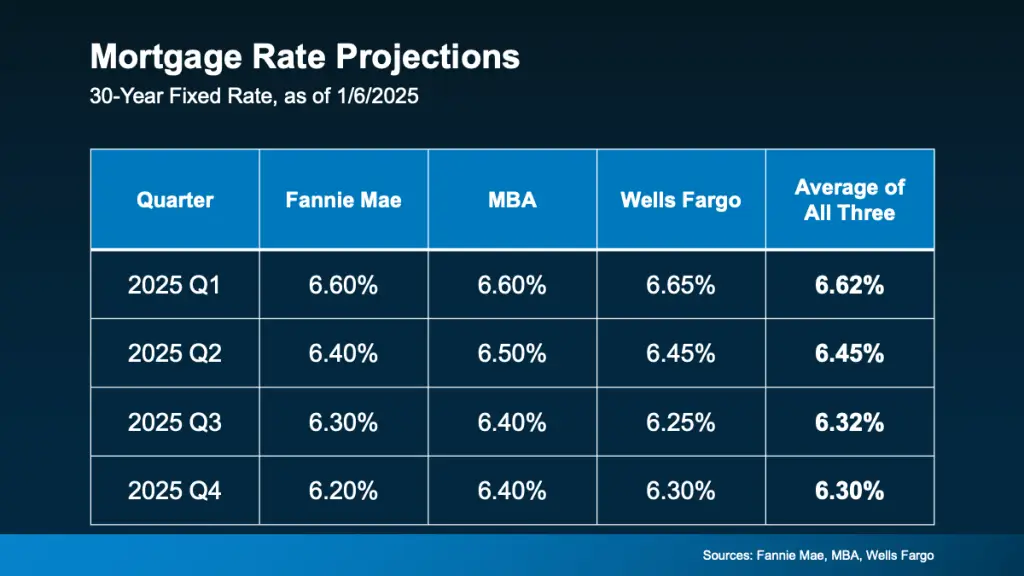

Yes, mortgage rates have trended downward over the last quarter, though the pace has transitioned from “dropping” to “stabilizing.” Most experts, including Fannie Mae and the MBA, predict that rates will hover between 5.9% and 6.3% throughout the first half of 2026. This “new normal” is driven by cooling inflation and the Federal Reserve’s pivot toward a more neutral monetary policy.

In Kansas City, we are seeing a unique “unfreezing” of the market. Many homeowners who were previously “locked-in” to 3% rates are now finding that a move into a 6% mortgage is financially manageable, leading to an 8.9% increase in local inventory. For a deeper look at how these rates have evolved, see our historical mortgage trends guide.

Factors Influencing Your 2026 Rate

- Federal Reserve Strategy: Markets are pricing in at least two additional minor cuts in 2026, which should keep long-term mortgage rates steady.

- 10-Year Treasury Yield: Mortgage rates track the 10-year Treasury yield more closely than the Fed’s short-term rate. Currently, yields are holding near 3.8%.

- Inventory Growth: With more homes hitting the KC market, lenders are competing harder for your business, often resulting in lower closing costs or rate buydown incentives.

- Local Demand: While neighborhoods like Prairie Village remain highly competitive, buyers in the outer metro are gaining more leverage.

Impact on the KC Market: Is Now the Time to Buy?

With rates moving toward 6%, the “wait-and-see” approach is becoming risky. As rates dip, more buyers re-enter the market, which can drive home prices higher. In Kansas City, the median home price has risen to approximately $371,531. If you wait for a 0.5% rate drop but home prices rise by 3% in that time, you may actually end up with a higher monthly payment.

For those already in a home, if your current interest rate is above 7.25%, a rate-and-term refinance could now save you significant money on your monthly obligation. Use our refinance calculator to see your break-even point.

How to Secure the Lowest Rate in 2026

- Get Fully Pre-Approved: In a balanced market, a verified pre-approval is your strongest negotiating tool.

- Watch for Appraisal Gaps: Even with better rates, bidding wars can lead to appraisal gaps. Be prepared with a strategy.

- Consider Loan Programs: If you are a veteran or buying in a rural area, VA loans and USDA loans currently offer rates significantly lower than the conventional 6.01% average.

Frequently Asked Questions

Will rates drop to 3% again?

Most economists agree that the era of sub-4% rates was an anomaly. A stable range of 5.5% to 6.2% is the likely long-term outlook for the mid-2020s.

What is the average credit score needed for the best rates in KC?

To secure the “headline” rates (currently near 6%), lenders typically look for a score of 740 or higher.

Should I use a bridge loan if I haven’t sold my home yet?

Yes, bridge loans are popular in 2026 to help sellers compete as “non-contingent” buyers. Learn more in our bridge loan guide.