As we navigate the economic landscape of 2025, many homeowners are turning their attention to…

Refinancing in Overland Park: Your Guide to Lower Rates & Smarter Savings

Refinancing is one of the most effective ways for Overland Park homeowners to reduce their monthly mortgage payments, shorten their loan term, or tap into built-up equity. But with today’s changing interest-rate environment, knowing whether a refinance makes sense — and which type is right for you — isn’t always simple.

This guide breaks down the most important questions homeowners ask, how refinancing in Overland Park works, and what to expect when you explore your options with a local lender.

Why Overland Park Homeowners Are Refinancing in 2025

Overland Park continues to benefit from strong home values, steady job growth, and low unemployment. Because of this, many homeowners have gained significant equity — which creates new refinancing opportunities.

Common reasons homeowners refinance include:

-

Securing a lower interest rate

-

Reducing the monthly mortgage payment

-

Moving from an ARM to a fixed-rate mortgage

-

Shortening the loan term to pay off the home sooner

-

Removing private mortgage insurance (PMI)

-

Using equity for debt consolidation or home improvements

-

Accessing cash through a cash-out refinance

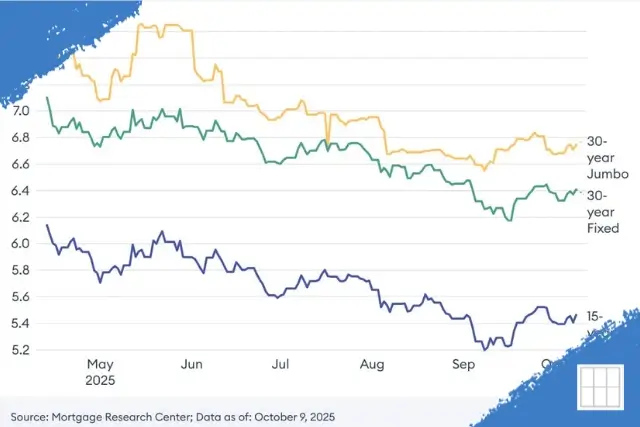

If your current rate is higher than what today’s market offers — or if your financial goals have changed — refinancing may help you save money more efficiently.

The Top Questions Homeowners Ask About Refinancing

1. Will refinancing actually save me money?

The two biggest factors are your new interest rate and loan term. Even a modest rate drop can lower your payment and reduce long-term interest costs. Your lender will calculate your true projected savings and help you determine whether refinancing in Overland Park puts you ahead financially.

2. What are the costs to refinance?

Refinancing includes standard closing costs such as appraisal fees, title fees, and lender charges. Most homeowners either pay these upfront or roll them into the loan amount. A lender will provide a full cost breakdown before you commit.

3. How much equity do I need?

To avoid PMI, lenders typically look for at least 20% equity, but you can still refinance with less. Cash-out refinances require additional equity because you’re taking money out of your home.

4. How does my credit score impact my refinance?

Credit score affects both your interest rate and the loan options available. Even small improvements in credit can result in noticeably better pricing.

5. Should I choose a rate-and-term refinance or a cash-out refinance?

It depends on your goals:

-

Rate-and-term refinance → Lower your payment or shorten your term

-

Cash-out refinance → Access home equity for renovations, debt consolidation, or major expense.

VA homeowners in Overland Park may also qualify for a VA IRRRL for faster approval and lower costs. Learn more about your options in our Overland Park VA Loans resource.

6. What’s my break-even point?

Your break-even point is how long it takes for your refinance savings to exceed your closing costs. If you expect to stay in your home beyond that point, refinancing is generally beneficial.

7. Can I refinance if I have a second mortgage or HELOC?

Yes, but the process may involve subordinating the second mortgage or adjusting how your liens are structured. A lender will guide you through any requirements.

Understanding Your Refinance Options in Overland Park

✔ Rate-and-Term Refinance

Ideal if you want long-term interest savings, lower monthly payments, or to convert an ARM into a stable fixed rate.

✔ Cash-Out Refinance

Leverages your home’s equity to access cash. Many homeowners in Overland Park use this option for remodeling projects or debt consolidation.

✔ Shorter-Term Refinance (20-year or 15-year)

Allows you to pay off your home sooner and reduce lifetime interest — often at a lower rate than 30-year loans.

✔ Removing PMI Through Refinance

Because Overland Park home values have climbed steadily, many homeowners can eliminate PMI earlier by refinancing at today’s market value.

When Is the Right Time to Refinance?

You may be a strong candidate for refinancing in Overland Park if:

-

Your current rate is 0.5%–1% higher than today’s available rates

-

You want to eliminate PMI

-

You plan to stay in your home long enough to pass the break-even point

-

Your credit profile has improved

-

You want to consolidate debt using a lower mortgage rate

-

Your ARM is set to adjust and you prefer payment stability

Every homeowner’s situation differs, so personalized guidance is essential.

Why Work With a Local Overland Park Lender?

Refinancing decisions are easier when you work with a team that understands the Overland Park housing market, property values, and local lending requirements.

Metropolitan Mortgage has served Kansas and Missouri homeowners for decades with:

-

Same-day pre-approvals

-

Local underwriting and fast closings

-

Transparent rate comparisons

-

Access to every major refinance loan type

-

Personalized guidance based on local market data

Learn more about our team here:

👉 https://www.emetropolitan.com/locations/overland-park/

You can also compare refinance options with a local expert:

👉 https://www.emetropolitan.com/overland-park-mortgage-lenders/

Final Thoughts: Is Refinancing Right for You?

Refinancing can create meaningful financial advantages — lower monthly payments, better long-term savings, shorter timelines to full ownership, or access to equity for important needs. But the right choice depends on your goals, home value, credit, and how long you plan to stay in your property.

If you’re an Overland Park homeowner wondering whether refinancing makes sense this year, our local mortgage experts can help you evaluate every option with clarity and confidence.