Overland Park, Kansas, consistently ranks as one of the best places to live in the…

Jumbo Loans in Overland Park: Your Guide to Financing High-Value Homes

Buying a luxury or higher-priced home in Overland Park comes with unique opportunities — and often unique financing needs. As property values continue to rise across Johnson County, more homes are now exceeding standard conforming loan limits. When that happens, a jumbo loan becomes the key to making your purchase possible.

What Is a Jumbo Loan?

A jumbo loan is a mortgage that goes above conventional conforming loan limits established by federal guidelines. Once a home’s price surpasses those limits, traditional financing is no longer sufficient. Instead, buyers use a jumbo loan, which allows them to finance a larger home with one single mortgage.

Why Jumbo Loans Exist

Conforming loan limits were created to reduce lender risk for average-priced homes. But in strong real estate markets — especially areas like Overland Park — many desirable homes fall outside those boundaries. Jumbo loans fill this gap by offering:

-

Access to higher-priced properties

-

Flexible loan terms similar to standard mortgages

-

Ability to finance luxury homes, custom builds, or estate properties

For buyers targeting upscale communities, a jumbo loan is often the most straightforward path to securing the home you want.

How Jumbo Loans Work in Overland Park

Overland Park consistently ranks among the highest-demand real estate markets in the Midwest. With excellent schools, low crime rates, and a strong local economy, the area attracts buyers seeking premium homes — many of which exceed conforming loan limits.

Because of that, jumbo loans are commonly used for:

-

Newly built luxury homes

-

Homes in premium subdivisions

-

Larger, custom, or estate-style properties

-

Upscale golf course or gated communities

-

Multi-acre residences within city limits

How Jumbo Loans Differ From Conventional Loans

While jumbo loans share many similarities with standard home mortgages, key distinctions help lenders manage the increased loan size.

1. Credit Requirements

Lenders typically expect strong credit history. Higher scores help secure more competitive rates and smoother approval.

2. Down Payment Expectations

While some programs allow lower down payments, many jumbo loans require 10–20% down depending on the loan structure and borrower profile.

3. Income and Documentation

Because of the larger loan amount, lenders review your income, assets, and financial stability more closely. Expect detailed documentation during underwriting.

4. Cash Reserves

In many cases, lenders may require several months of reserves to ensure you can comfortably manage the payment.

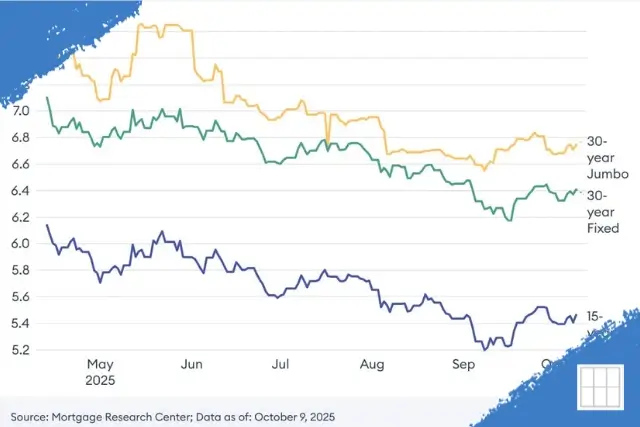

Despite these additional steps, qualifying is more straightforward than many buyers expect — especially with strong credit, stable income, and professional guidance. Jumbo loan rates can differ from standard conforming loans. You can review today’s trends on our current mortgage interest rates page.

Overland Park Neighborhoods With Frequent $1 Million+ Home Sales

Overland Park offers a wide range of premium neighborhoods where luxury homes are common. These communities often feature custom construction, high-end finishes, premium amenities, and large lots — making them ideal environments for jumbo financing.

Here are some of the most notable subdivisions:

1. The Farm at Garnet Hill

Luxury, custom-built estate homes on spacious lots with architectural variety and a private, upscale setting.

2. Lionsgate

A sought-after, master-planned community with golf course scenery, wide streets, and consistently high-value homes.

3. Hallbrook

One of Overland Park’s premier luxury neighborhoods, known for exceptional properties, mature landscaping, and a private country club.

4. Sundance Ridge

A newer, high-end development offering spacious lots, elevated architectural styles, and premium community amenities.

5. Mills Farm

A prestigious master-planned community featuring large homes, modern designs, and family-focused community spaces.

6. Century Farms

A contemporary luxury neighborhood with a blend of custom builders, high-end finishes, and community green spaces.

7. Nottingham Forest

A well-established neighborhood where certain large or extensively renovated homes regularly exceed $1 million.

8. Iron Horse Estates

Golf-course living with upscale homes, scenic views, and a peaceful, private community environment.

9. Wilshire by the Lake

A beautiful lakeside community with custom-built luxury homes and premium neighborhood amenities.

10. Terrybrook Farms

A fast-growing, upscale community featuring modern layouts, large lots, and multiple luxury-level builders.

These neighborhoods represent just a portion of the high-end housing available within Overland Park — and all are strong candidates for jumbo loan financing. If you’re comparing neighborhoods or planning your next move, our guide on buying a home in Overland Park offers additional insights.

Who Should Consider a Jumbo Loan?

A jumbo loan may be the right choice if you:

-

Are purchasing a luxury or custom home

-

Want a single loan rather than combining multiple mortgages

-

Have strong credit and stable financial reserves

-

Plan to buy in a subdivision where homes frequently exceed $1 million

-

Want to secure a higher-priced property without compromising features or location

Whether you’re upgrading, relocating, or purchasing a long-term family home, a jumbo loan offers the financing flexibility needed for premium real estate.

Understanding the Market Before You Buy

Before selecting a home in the luxury range, it’s helpful to understand price trends, demand, and neighborhood performance.

You can review our full market breakdown here:

Overland Park Housing Market

This analysis offers updated pricing data, appreciation trends, and insights into where high-end homes are most competitive.

Ready to Learn More About Jumbo Loans?

If you’re considering a luxury home in Overland Park, Metropolitan Mortgage can guide you through your financing options. We help buyers understand qualification requirements, compare loan structures, and determine the best financing strategy for their goals.

Contact Metropolitan Mortgage in Overland Park today to review your jumbo loan options and get personalized guidance for your home purchase.