Kansas City Mortgage FAQs Welcome to the Kansas City mortgage FAQs page for Metropolitan Mortgage…

How to Read and Compare Loan Estimates

One of the most important mortgage disclosures you’ll examine when comparing home loan offers is the loan estimate. However, the loan estimate form contains a plethora of precise information. There are key points to keep in mind so that you can accurately compare loan terms and closing expenses and prevent unpleasant surprises when it comes time to sign the closing disclosure and closing documents.

What is a mortgage loan estimate?

A mortgage Loan Estimate is a three-page form from the lender that provides important loan details about the loan you’ve applied for. Such as the estimated interest rate, monthly payment, and total closing expenses for the loan. The Loan Estimate also provides the expected costs of taxes and insurance and any future changes to the interest rate and payments.

The form also reflects any unique characteristics you should be aware of, such as prepayment penalties or increases to the mortgage balance even with on-time payments (negative amortization). If your loan has negative amortization, it states so in its description.

Thanks to the form’s straightforward language and layout, you can better grasp the terms of the mortgage loan you’ve applied for. All lenders must use the standard Loan Estimate form, making it simpler to compare mortgages and select the best one for you.

When you receive a Loan Estimate, the lender has not yet approved or rejected your loan application. Read the Loan Estimate as it outlines the loan terms the lender anticipates providing if you decide to proceed. The lender will need more financial details if you wish to move forward.

When will I get the loan estimate?

After receiving your application, the lender has three business days to send you a Loan Estimate. The lender will require your full legal name, income documentation, Social Security number, loan amount, property address, and sales price.

How to read and compare loan estimates

Whether you’re purchasing a home or refinancing, the loan estimate is essential, so understanding the information is vital. Below, we provide a detailed explanation of each section labeled on the form.

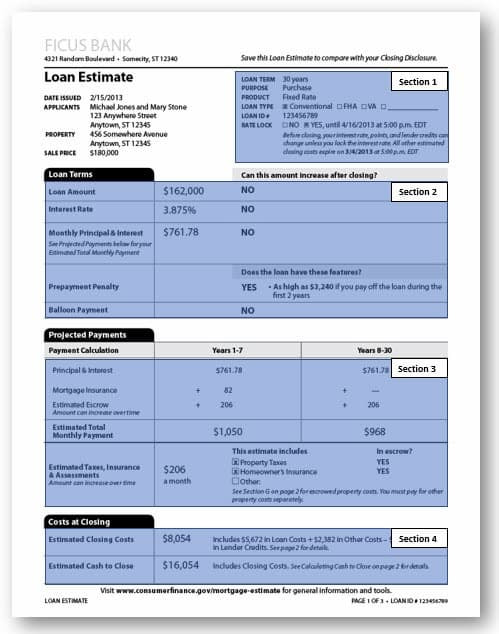

Page 1 of the loan estimate

Section 1

- Loan term – The duration of the mortgage in years (such as 30 years)

- Purpose – The type of financing is for, such as a “purchase” or “refinance.”

- Product – The kind of mortgage it is, such as a “fixed rate” or an “adjustable-rate” mortgage.

- Loan type – The selected loan, such as conventional, FHA, USDA, or VA loan.

- Rate lock – If the interest rate is locked and the date the lock expires.

Section 2

- Loan amount – The mortgage amount and whether it can increase

- Interest rate – The interest rate, as a percentage, and if it can change. If the right-hand column says “YES,” your interest rate is adjustable.

- Monthly principal and interest – The monthly mortgage payment, which does not include the homeowner’s insurance and property taxes

- Prepayment penalty – If the loan has a prepayment penalty, it will include the amount and term. This function poses a risk. Find out more and inquire with your lender about alternatives if your loan has a prepayment penalty.

- Balloon payment – If there’s a balloon payment, a large sum is due at the end of the initial loan term. This function poses a risk. Ask your lender about your other options if your loan has a balloon payment.

Section 3

- Estimated total monthly payment – The estimated monthly mortgage payment which includes the principal and interest, taxes, insurance, and PMI, if applicable

- Estimated taxes, insurance, and assessments – The total of the estimated homeowner’s insurance and property taxes, and if they are included in your monthly payment

Section 4

- Estimated closing costs – The closing costs associated with the mortgage.

- Estimated cash to close – Includes any money you have already paid and the sum you will need to pay at closing. Usually, a cashier’s check or wire transfer is used to pay for this.

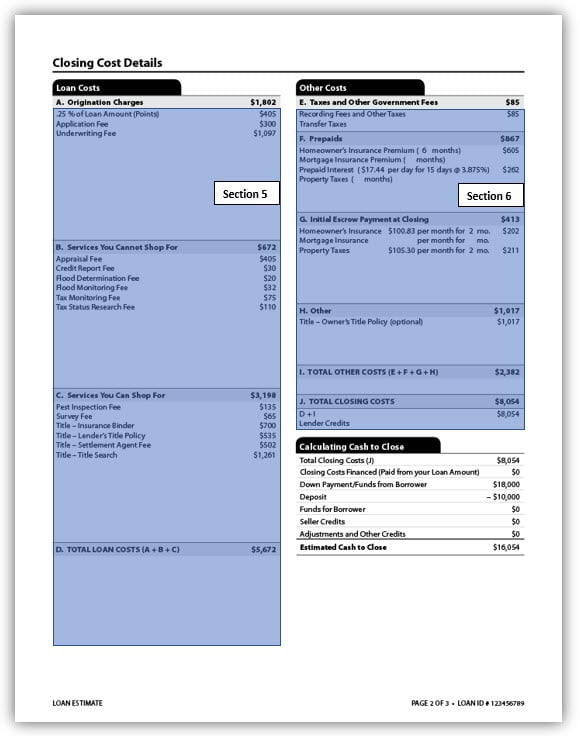

Page 2 of the loan estimate

Section 5

- A: Origination charges – This section includes lender fees, such as Origination fees, which are upfront fees charged by the lender, including a fee for initiating the mortgage, application fee, underwriting fee, administration, and other lender charges. Including any discount points, you may be purchasing for a lower interest rate.

- B: Services you cannot shop for – A list of services and fees necessary to close the mortgage. Such as an appraisal and credit report.

- C: Services you can shop for – A list of services necessary to close the mortgage and their related charges, such as the title search and survey, allows you to choose the provider.

- D: Total loan costs – The total of A, B, and C

Section 6

- E: Taxes and other government fees – A fee is associated with filing the mortgage with the county.

- F: Prepaids – Prepaids are upfront payments for homeowners’ insurance, property taxes, and mortgage interest.

- G: Initial escrow payment at closing – The homeowner’s insurance premiums and property taxes that will be in your escrow account

- H: Other – This is for an owner’s title insurance policy

- I: Total other costs – The total of E, F, G, and H

- J: Total closing costs – The total of parts D and I

The Estimated Cash to Close is the amount of cash that is due at closing. This can be in the form of a cashiers check or wire.

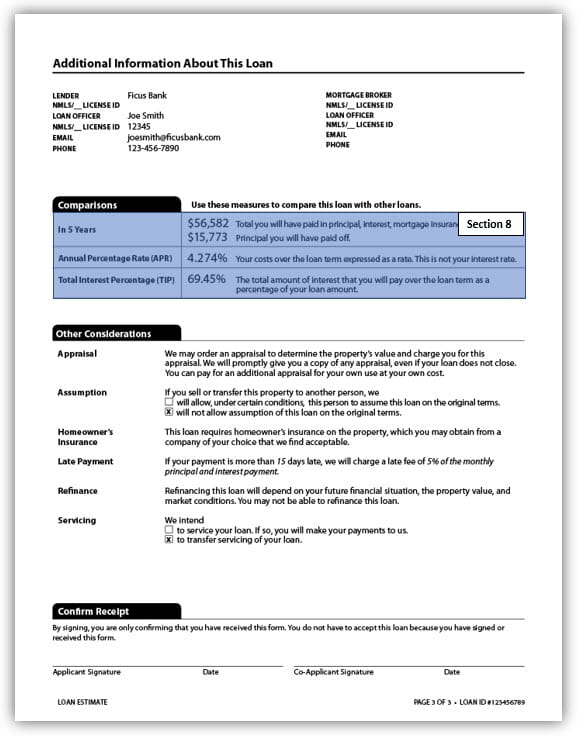

Page 3 of the loan estimate

Section 8

- The total amount of the loan principal, as well as the total principal, interest, and mortgage insurance, will you pay down in the first five years of the loan.

- The Annual Percentage Rate (APR) is the cost you pay each year to borrow money, including fees, expressed as a percentage. This is often confused with the interest rate.

- The amount of interest you will pay over the loan’s term is stated as a percentage of the total interest percentage.

What should I look for on the loan estimate?

The Consumer Financial Protection Bureau (CFPB) recommends that you confirm that all of the information on the loan estimate is correct, including the spelling of your name and the loan amount and term.

A lender may provide you with an initial loan worksheet, which can be any document explaining your terms, such as estimated rates, terms, and payments based on the initial information you’ve provided. However, your actual costs and rates could be higher unless it’s an official Loan Estimate. If there are significant changes to your terms, rates, or other significant information, you should receive a revised Loan Estimate.

The property address should appear on the estimate; however, you don’t need a signed contract on a home. Ideally, you’d request quotes from several lenders before you enter an agreement to buy a house. This should help you be sure that you fully understand the costs and terms and that you’re choosing the right loan and lender.

Choosing the right mortgage loan is a critical step in the home buying process. Make sure you are comfortable with the loan terms and the lender proceeding. Ask questions until you you’re able to commit to the loan.

THINGS TO KNOW

There are regulations that lenders must follow after the loan estimates have been disclosed. Here are the three “tolerance” levels mortgage lenders must follow:

Zero Tolerance – Lenders must not charge consumers more than the amount disclosed on the Loan Estimate unless a changed circumstance or other triggering event permits a revised estimate.

10% tolerance – The lender must cover the excess in this section if 10% over the initial quote. Included are charges from other parties such as title insurance, escrow fees, and recording expenses.

No tolerance – These fees include property taxes on your home and homeowners’ insurance. However, the 10% tolerance would apply if the lender chose the title company.

Are you ready to Apply for a Mortgage?

Since 1997, Metropolitan Mortgage has been helping countless buyers secure the mortgage products they need to help finance such a large purchase. With various mortgage programs, we are the number one mortgage resource for borrowers in Kansas and Missouri. We have been a family-run business operation since 1997 and work hard to help borrowers realize their dreams of owning a home. Contact us today with any questions about applying for a mortgage our explore our loan calculator.