Kansas City Mortgage FAQs Welcome to the Kansas City mortgage FAQs page for Metropolitan Mortgage…

Closing Disclosure: A Detailed Explanation

The Closing Disclosure describes the terms of your mortgage loan, including the purchase price, interest rate, estimated property taxes, insurance, closing costs, and other related expenses. You must review all five pages thoroughly as it’s one of the most important steps you can take while buying or refinancing a home.

Why It’s Essential to Review Your Closing Disclosure

If you’re buying a home or refinancing your current loan, you must understand all the terms of your loan before you sign. Because you’re committing to the terms presented once you sign.

You should carefully read the Closing Disclosure form your lender sends you – which will be provided at least three days before closing. These are the final forms you receive before closing on your home loan. You should compare the terms on the Loan Estimate to the Closing Disclosure and make sure the loan terms and costs are similar.

Mortgage forms can be challenging to read, and there is no exception for the Closing Disclosure, especially if you’re not unsure what to look for. Read the complete form first, then contact your Loan Officer with any questions. If there are any desired changes, now is the time to address them.

The Closing Disclosures 3-Day Timeline

A lender must give you the standardized Closing Disclosure at least three business days before closing, and this timeframe helps promote a smooth closing process. Metropolitan Mortgage does not want you to feel confused or pressured at the closing table; instead, we want you to feel prepared and collected.

Receiving the closing disclosure three (3) days in advance ensures you have had enough time to deal with any changes and are informed of what you will owe upon consummation. You know what the terms are well before you are in closing.

The Closing Disclosure must be signed at least 3-days before the closing to start the 3-day waiting period to close. Changes can be made to the forms after signing the forms.

How Does the Three-Day Rule Work?

The three-day rule applies to business days, which include Saturdays. Sundays and Nationally recognized holidays are not considered a “business day.” You may sometimes have more than three days to review the document before closing.

For example, the lender must have the closing disclosure to you by Tuesday to close on Friday. Thus giving you three days time to review the document before closing.

However, if you close on Tuesday, you will receive it the following Friday. In this case, you technically have four days to review the document before closing, but only three days are part of the three-day rule.

How to read the closing disclosure

Whether you’re purchasing a home or refinancing, the closing disclosure is essential, so understanding the information is vital. Below, we provide a detailed explanation of each section labeled on the form.

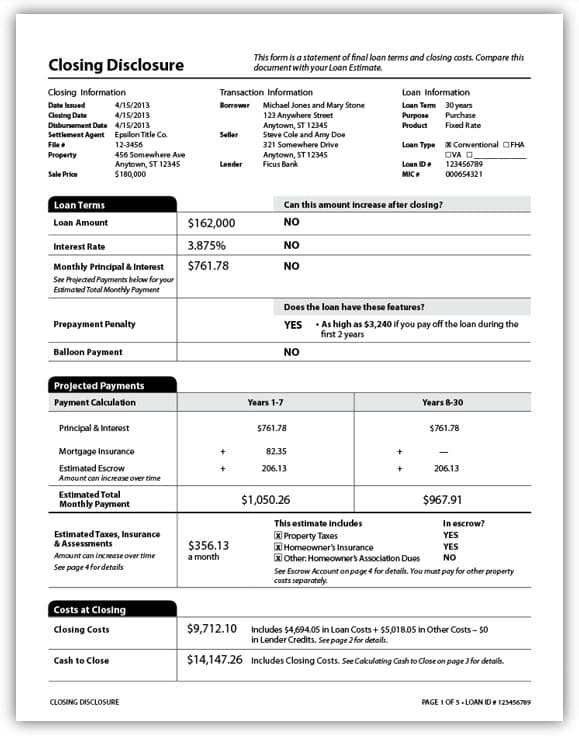

Page-1 of the Closing Disclosure

Loan Terms

This section of the disclosure form covers the key terms of your mortgage. It provides a quick snapshot of how much you’ll pay and how long.

- Loan amount: This is the total amount of money you are borrowing.

- Interest rate: The interest rate is the fee you pay for borrowing money.

- Monthly principal and interest: The total monthly mortgage payment for principal and interest payment, which does not include property taxes, homeowners insurance, or mortgage insurance.

- Prepayment penalty: Some lenders charge a prepayment penalty when a borrower pays off their mortgage early. Metropolitan Mortgage does not charge a prepayment penalty on any loan we offer.

- Balloon payment: A balloon payment is a required lump sum payment due at the end of the initial loan term. These loans are deemed risky because of the large amount due at the end of the loan. Metropolitan Mortgage does not offer loans with balloon payments.

Projected Payments

This section of the Closing Disclosure displays how the payments will change over the years. It gives you the best picture of what you owe monthly and year-to-year.

- Payment calculation: Your mortgage loan consists of monthly payments to the principal and interest, mortgage insurance (if applicable), and escrow (homeowners insurance and property taxes). This section reflects the breakdown for each of these payments during the term of your loan. If your mortgage payment can change (for example, an adjustable-rate mortgage), there will be a calculation for what your maximum amount can be at each change based on interest rate caps.

- Estimated total monthly payment: This is the total amount you’ll pay each month, which includes the principal and interest, mortgage insurance, and escrow amount. Your lender uses an escrow account to pay your property tax bills and homeowners insurance premiums as they become due.

- Estimated taxes, insurance, and assessments: This section covers the monthly escrow amount and what is included, such as the property taxes, homeowners insurance, and homeowners association dues. Be sure you budget for these costs throughout the year if there are not included in your escrow account.

Costs At Closing

The total closing costs and pre-paids are reflected here, and the breakdown of these charges is reflected on page 2 of the closing disclosure.

Cash to Close

Here you’ll find the amount you will need to close, which is the amount of money you’ll need to bring to closing. You can obtain a cashier’s check or wire for this amount. Should you choose to wire funds, you will need the wiring instructions from the title company.

At the top of Page 3, you will see the details on how this amount was calculated.

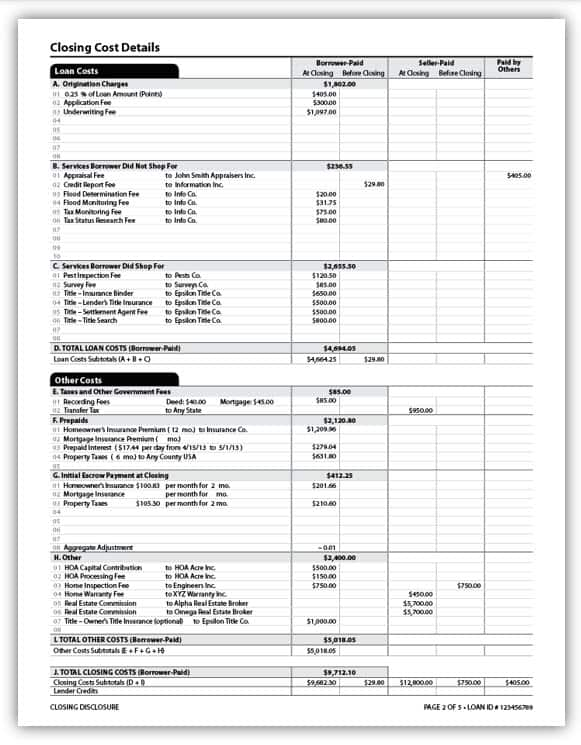

Page-2 of the Closing Disclosure

Loan Costs

This portion of the disclosure provides a comprehensive breakdown of the costs associated with your mortgage.

- Origination fee: The origination fee covers the administrative cost of your mortgage application.

- Mortgage points: Points (origination charges) are paid to buy down a lower interest rate. One point is equal to one percent of the mortgage balance. For instance, if your loan is $200,000, one point will cost you $2,000.

- Application fee: The application fee covers the processing cost of your application.

- Underwriting fee: A underwriter reviews your income, assets, and credit meets lending guidelines. The underwriting fee covers this review.

- Services borrower did not shop for: These are the services required by the lender. It may also include fees for appraisal, credit report, flood determination, etc.. Verify that these fees correspond to those on your loan estimate. The prices ought to be comparable as well; however, they might have altered a little.

- Services borrower did shop for: These are the third-party services that you may have independently shopped around for lower prices. They could consist of a pest inspection, a survey, and any services relating to title services (including title insurance, settlement agent, and title search fees).

Other Costs

Other expenses, like taxes and government fees, prepaids, the initial escrow payment at closing, and more, might also be covered by your mortgage.

- Taxes and other government fees: The costs for officially documenting the new deed and mortgage in the public records are shown below as recording fees.

- Prepaids: This section will explain the amount deposited into the escrow account. It covers various prepaid expenses, such as property taxes, prepaid interest, homeowners insurance premiums, or mortgage insurance premiums.

- Initial escrow payment at closing: This section will explain how the money deposited into the escrow account. It will include homeowners insurance, property taxes, and mortgage insurance.

- Other: You might also have additional costs to cover at closing, such as homeowners association dues, title insurance, real estate commissions, home warranty fees, and home inspection fees.

All additional expenses are totaled after this section to get a complete picture.

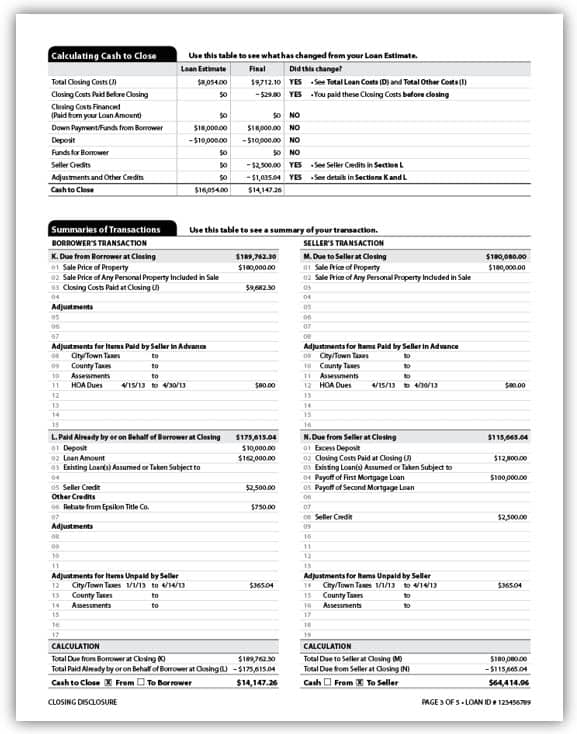

Page-3 of the Closing Disclosure

Calculating Cash To Close

The amount you need to bring to closing is known as “cash to close,” It also includes any deposits you have previously given the seller. It will also state how much the seller intends to contribute to your closing costs -seller concessions, and you bargain with the seller to cover these closing charges.

Summaries Of Transactions

This section compares the closing costs incurred by the borrower and the seller. You can view adjustments for any costs pre-paid by the seller, such as taxes, homeowners association dues, and assessments. It lets you view the seller’s closing obligations (such as payoff amounts of all mortgages, closing costs, seller credits, and more). It also shows how much you owe and how much you have already paid before closing.

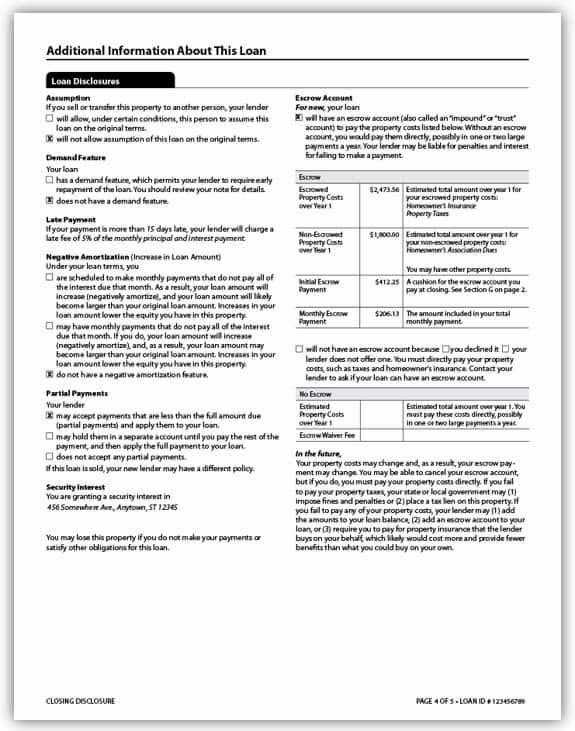

Page-4 of the Closing Disclosure

Loan Disclosures

The loan disclosure will show detailed information about the features of your loan, which include:

- Assumption: An assumable mortgage allows a buyer to assume the responsibility of the seller’s existing home loan without applying for a new loan. The remaining balance, interest rate, payments, and other terms would remain the same.

- Demand feature: If the demand feature is checked “yes,” the lender can require that you pay the entire loan balance at any time. The lender can make this demand on you for any reason or no reason.

- Late payment: it’s essential to know when a late payment fee is applied to your loan and how much. Paying your mortgage on time is also necessary to keep your credit score in good standing.

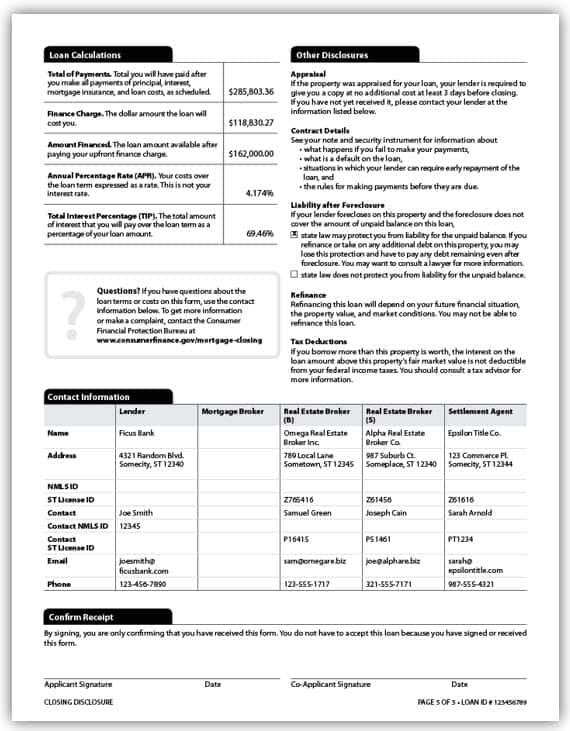

Page-5 of the Closing Disclosure

Loan Calculations

This section covers the total of all payments, the finance charge, Amount Financed, Annual Percentage Rate (APR), and the Total Interest Percentage.

Other Disclosures

In this section, you’ll find general information about the appraisal (if applicable), contract details, refinance info, and tax deductions.

Contact Information

This includes the contact information of the Lender or Mortgage Broker, the buyer and seller real estate agents, and the settlement agent with the title company.

Confirm Receipt

You must sign this document three business days before closing to meet your closing date. By signing this form, you are confirming receipt, and it does not mean you have accepted this loan by signing it; in other words, signing does not require you to take the loan.

THINGS TO KNOW

There are regulations that lenders must follow after the loan estimates have been disclosed. Here are the three “tolerance” levels mortgage lenders must follow:

Zero Tolerance – Lenders must not charge consumers more than the amount disclosed on the Loan Estimate unless a changed circumstance or other triggering event permits a revised estimate.

10% tolerance – The lender must cover the excess in this section if 10% over the initial quote. Included are charges from other parties such as title insurance, escrow fees, and recording expenses.

No tolerance – These fees include property taxes on your home and homeowners’ insurance. However, the 10% tolerance would apply if the lender chose the title company.

In Summary

The Consumer Financial Protection Bureau (CFPB) recommends that you confirm that all of the information on the closing disclosure is correct, including the spelling of your name and the loan amount and term.

You can see a detailed breakdown of your final costs in your Closing Disclosure, so you know what you’ll be responsible for paying at closing and throughout your loan term. In the Closing Disclosure explanation, you can learn about crucial elements of your mortgage loan, such as the purchase price, loan fees, interest rate, real estate taxes, closing costs, and other costs.

By carefully reading your Loan Estimate and Closing Disclosure, make sure what you see makes sense. Are you ready to apply for a home loan today? Apply for a mortgage online or call (913) 642-8300 to talk with one of our home loan specialists.