Buying a home in the Kansas City metro area—whether in Kansas City, MO, or Kansas…

Can You Afford Your Dream Home in Kansas City? Using an Affordability Calculator

Dreaming of a home in Kansas City, MO, or Kansas City, KS? Our affordability calculator helps you determine if your dream home fits your budget. Learn how to use it and understand how income, debts, and local costs like property taxes impact your homebuying power in the Kansas City metro.

Why Use an Affordability Calculator in Kansas City?

Kansas City’s housing market is attractive, with median home prices around $250,000–$300,000 in 2025, making it a great place for first-time buyers and families. However, costs like property taxes (~1.4% in Kansas City, MO; ~1.6% in Kansas City, KS) and homeowners insurance (~$1,200/year) can affect affordability. Our affordability calculator takes these factors into account, helping you set a realistic budget for your dream home in neighborhoods like Brookside, Waldo, or Overland Park.

How to Use Our Kansas City Affordability Calculator

Our calculator estimates the home price you can afford based on your financial profile and local market conditions. Follow these steps:

1. Enter Your Monthly Income

Input your gross monthly income (before taxes). For example, a Kansas City household earning $60,000/year has a monthly income of $5,000. This is the starting point for calculating your budget.

2. List Your Monthly Debts

Include debts like car loans, student loans, or credit card payments. Lenders in Kansas City prefer a debt-to-income ratio (DTI) below 43%, with 33% or less for housing. If you have $1,000 in monthly debts, $1,650 of a $5,000 income can go toward your mortgage, taxes, and insurance.

3. Choose a Down Payment

A larger down payment lowers your loan amount and monthly payments. Kansas City buyers can explore:

- Conventional Loans: Typically 5–20% down ($12,500–$50,000 for a $250,000 home).

- FHA Loans: As low as 3.5% down ($8,750 for a $250,000 home). Try our FHA calculator.

- VA Loans: 0% down for veterans. Use our VA calculator.

- MHDC Programs: Missouri Housing Development Commission offers down payment assistance for Kansas City, MO, buyers.

4. Input Interest Rates and Loan Term

Kansas City mortgage rates in 2025 are ~6.5–7% for a 30-year fixed loan. A $200,000 loan (after 20% down on a $250,000 home) at 6.5% has a monthly principal and interest payment of ~$1,264. Add ~$292/month for taxes (1.4%) and $100/month for insurance, totaling ~$1,656/month.

Try It Now: Use our affordability calculator to test different scenarios and find your dream home’s price range.

What Affects Affordability in Kansas City?

Several factors determine how much home you can afford in Kansas City:

- Property Taxes: Kansas City, MO (Jackson County) taxes are ~1.4% ($3,500/year for a $250,000 home), while Kansas City, KS (Wyandotte County) is ~1.6% ($4,000/year).

- Home Prices: Neighborhoods vary, from $200,000 in Waldo to $350,000 in Lee’s Summit. Our calculator helps you target the right area.

- Insurance: Expect ~$1,200/year, higher in storm-prone areas like Raytown.

- Other Costs: HOA fees (e.g., in Overland Park) or maintenance (~$2,500/year for a $250,000 home) add to your budget.

Our calculator includes these local costs for an accurate estimate. Check your monthly payment with our mortgage calculator.

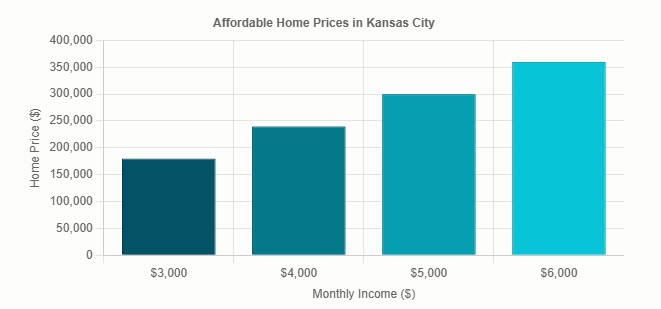

Kansas City Affordability by Income

Here’s how much home you might afford in Kansas City based on your income (assuming 20% down, 6.5% interest, 30-year loan):

Chart: Affordable home prices in Kansas City based on monthly income, including local taxes and insurance.

Use our affordability calculator to get a personalized estimate for your dream home.

Tips to Afford Your Dream Home in Kansas City

- Leverage Local Programs: Missouri’s MHDC offers down payment assistance for Kansas City, MO, buyers, while Kansas Housing Resources supports Kansas City, KS. Explore low-down-payment options with our FHA calculator.

- Choose Affordable Neighborhoods: Areas like Waldo or Raytown offer homes under $250,000, ideal for first-time buyers.

- Compare Lenders: Kansas City credit unions like CommunityAmerica may have lower rates. If you’re refinancing, use our refinance calculator.

- Reduce Debts: Paying down credit cards lowers your DTI, increasing your budget. Test scenarios with our affordability calculator.

Start planning today with our affordability calculator!

Frequently Asked Questions

How much home can I afford in Kansas City with $5,000 monthly income?

With $5,000 monthly income and $1,000 in debts, you could afford a $250,000–$300,000 home in Kansas City, MO, with a 20% down payment. Try our affordability calculator for a custom estimate.

Do Kansas City property taxes affect affordability?

Yes, taxes (~1.4% in Kansas City, MO; ~1.6% in Kansas City, KS) add $292–$333/month for a $250,000 home. Our calculator includes these for accuracy.

What programs help Kansas City first-time buyers afford a home?

Missouri’s MHDC offers down payment assistance, and FHA loans require only 3.5% down. Veterans can use VA loans with 0% down.

More Kansas City Homebuying Resources

Explore our tools and guides to make your dream home a reality:

- Affordability Calculator – Find your Kansas City home budget.

- Mortgage Calculator – Estimate monthly payments with taxes and insurance.

- How to Budget for a Home in Kansas City – Step-by-step budgeting guide.

- First-Time Homebuyer Programs in Kansas City – Local assistance options.

- View All Mortgage Guides – More Kansas City tips.