15-Year Fixed Mortgage: A Guide for Homebuyers and Homeowners

When considering mortgage options, a 15-year fixed mortgage stands out as a popular choice. This guide will help you understand what a 15-year fixed loan is, its benefits, and considerations to keep in mind.

What is a 15-Year Fixed Mortgage?

A 15-year fixed mortgage is a home loan with a fixed interest rate and constant monthly payments for 15 years. Unlike adjustable-rate mortgages (ARMs), the interest rate on a fixed mortgage does not change. This provides stability and predictability for borrowers.

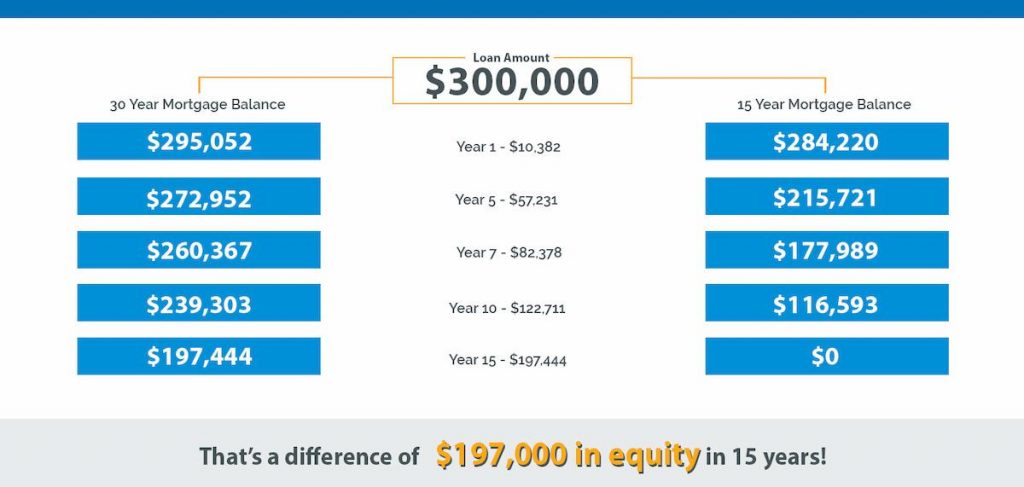

The shorter term means you’ll pay off your home in half the time of a traditional 30-year mortgage. This can be advantageous for building equity quickly and reducing the total interest paid.

Benefits of a 15-Year Fixed Mortgage

Opting for a 15-year fixed mortgage offers several advantages:

Faster Home Equity Building

With a shorter loan term, you pay off your mortgage faster, building home equity more quickly. Home equity is the portion of your property that you truly “own.” This can be beneficial if you plan to sell your home or take out a home equity loan in the future.

Lower Interest Rates

15-year fixed mortgages typically come with lower interest rates compared to 30-year fixed mortgages. This means you pay less in interest over the life of the loan, potentially saving you thousands of dollars.

Significant Interest Savings

By paying off your mortgage in 15 years instead of 30, you can save a significant amount of money in interest payments. For example, on a $200,000 loan, the interest savings can amount to tens of thousands of dollars.

Predictable Payments

A fixed-rate mortgage ensures that your monthly payments remain the same throughout the term of the loan. This predictability can make budgeting easier and provide peace of mind.

Considerations Before Choosing a 15-Year Fixed Mortgage

While a 15-year fixed mortgage offers many benefits, there are important considerations:

Higher Monthly Payments

Monthly payments for a 15-year fixed mortgage are higher than those for a 30-year mortgage. This is due to the accelerated repayment schedule. Ensure that your budget can accommodate these higher payments before committing to this loan type.

Budgeting for a 15-Year Term

Careful budgeting is essential when opting for a 15-year mortgage. Consider your income stability, other financial obligations, and emergency savings. The higher payments can be challenging but also mean you’ll be mortgage-free sooner.

Opportunity Cost

Higher monthly mortgage payments mean you might have less disposable income for other investments or expenses. Weigh the benefits of paying off your mortgage quickly against potential missed opportunities, such as investing or saving for retirement.

Less Flexibility

A 15-year mortgage requires a greater financial commitment each month, which might reduce your financial flexibility. If you face an unexpected expense or a change in income, the higher payment could become a burden.

Is a 15-Year Fixed Mortgage Right for You?

A 15-year fixed may be ideal if you have a stable income, want to build equity quickly, and are comfortable with higher monthly payments. It’s also a great option if you plan to stay in your home long-term and want to pay off your mortgage faster. However, it’s not suitable for everyone. If you’re unsure about your future income stability or have other significant financial goals, a 30-year mortgage might provide the flexibility you need.

How to Apply for a 15-Year Fixed Mortgage

Applying for a 15-year fixed mortgage is similar to other mortgage types. Here are the steps you should follow:

- Check Your Credit Score: A higher credit score can help you secure a better interest rate. Review your credit report for any errors and take steps to improve your score if necessary.

- Gather Financial Documents: Lenders will require documentation of your income, assets, and debts. Prepare recent pay stubs, tax returns, bank statements, and information about any other loans or credit accounts.

- Compare Rates from Multiple Lenders: Interest rates can vary significantly between lenders. Shop around and compare offers to find the best deal.

- Get Pre-Approved: A pre-approval letter from a lender shows sellers that you’re a serious buyer and can afford the home you’re interested in.

- Consider Working with a Mortgage Broker: Brokers can help you navigate the mortgage process and may have access to special rates or programs that aren’t widely advertised.

Frequently Asked Questions

Can I refinance to a 15-year fixed mortgage? Yes, refinancing to a 15-year fixed mortgage is a common option for homeowners. It can help you pay off your loan faster and save on interest.

What are the credit score requirements for a 15-year fixed mortgage? Credit score requirements vary by lender. Generally, a higher credit score can help you secure a better interest rate. Most lenders look for a score of at least 620.

Are there prepayment penalties for a 15-year fixed mortgage? Most lenders do not charge prepayment penalties, but it’s important to check the terms of your loan agreement.

By understanding the ins and outs of a 15-year fixed mortgage, you can make an informed decision that aligns with your financial goals. Whether you’re buying a new home or refinancing an existing loan, a 15-year fixed offers a path to faster homeownership and significant interest savings.