Welcome to Olathe, Kansas, a vibrant city known for its family-friendly atmosphere and growing economic…

Fed Cuts Rates in September 2025: How It Lowers Your Mortgage Costs and What to Do Next

As the housing market continues to evolve, big news from the Federal Reserve can make all the difference for homebuyers and homeowners alike. On September 17, 2025, the Fed made headlines by cutting its benchmark federal funds rate by 0.25 percentage points, bringing it to a range of 4.00%-4.25%. This is the first rate reduction in nine months and hints at more to come later this year. At Metropolitan Mortgage, we’re excited about what this means for you—potentially lower borrowing costs and more opportunities in the real estate world. Let’s break it down and explore how this decision could impact your next move.

Background on the Federal Funds Rate

First things first: What exactly is the federal funds rate, and why does it matter? It’s the interest rate at which banks lend money to each other overnight, set by the Federal Open Market Committee (FOMC). While it doesn’t directly dictate mortgage rates, it influences them heavily. When the Fed lowers this rate, it signals a shift toward stimulating the economy, often leading to reduced costs for loans, credit cards, and yes—mortgages.

Think of it like the Fed easing the pressure on the economy’s accelerator. This cut comes in response to a softening labor market, with the Fed aiming to maintain inflation around 2% in the long term. Interestingly, newly appointed Governor Stephen Miran was the sole dissenter in the decision, underscoring some debate on the timing and pace of these changes.

How This Affects Mortgage Rates and the Housing Market

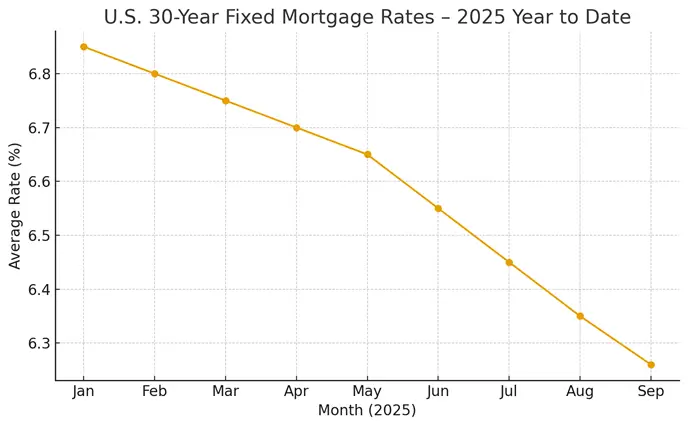

This rate cut is a game-changer for the housing sector. Kansas City mortgage rates, which are influenced by the Fed’s actions along with other factors like Treasury yields and investor sentiment, are likely to trend downward in the weeks ahead. Pre-cut, average 30-year fixed mortgage rates hovered around 6-7%, but we could see them dip slightly, making homeownership more accessible.

Here’s a closer look at the potential impacts:

- For Homebuyers: Lower rates translate to smaller monthly payments. For example, on a $400,000 loan, even a 0.25% reduction could save you hundreds of dollars each year, freeing up cash for other priorities like home improvements or savings.

- For Refinancers: If you locked in a higher rate during the peak periods of 2023-2024, now might be the perfect time to refinance. This could shave thousands off your total loan cost over time.

- Overall Market Boost: With financing becoming more affordable, expect increased buyer activity. If housing inventory continues to rise, this could create a more balanced market, giving buyers better negotiating power.

Fed officials project the benchmark rate could fall to the 3.5%-3.75% range by the end of 2025, suggesting at least two more quarter-point cuts. To illustrate the savings, check out this quick table based on current estimates:

| Scenario | Pre-Cut Mortgage Rate (Est.) | Post-Cut Potential Rate | Monthly Payment Savings on $300K Loan (30-Year Fixed) |

|---|---|---|---|

| Base Case | 6.5% | 6.25% | ~$50-75 |

| Optimistic | 6.5% | 6.0% | ~$100-150 |

These are approximations—actual rates depend on your credit, loan type, and market conditions. Always consult with a lender for personalized quotes.

Potential Risks and Considerations

While this news is largely positive, it’s not all smooth sailing. Mortgage rates can still fluctuate based on upcoming economic data, such as inflation reports or employment figures. External factors like geopolitical events or policy changes (think tariffs) could introduce new inflationary pressures, potentially limiting how much rates drop.

Our advice? Don’t try to time the market perfectly—rates might not plummet overnight. Set up rate alerts and stay informed. If you’re serious about buying or refinancing, acting sooner could lock in benefits before any reversals.

Expert Advice from Metropolitan Mortgage

At Metropolitan Mortgage, we’ve been helping families navigate these shifts for years. Our team has already seen a spike in inquiries following the Fed’s announcement, and we’re here to guide you through it. Here are some pro tips:

- Check Your Credit: A strong score can secure the best rates. Pull your report and address any issues early.

- Explore Options: Consider adjustable-rate mortgages (ARMs) if you expect rates to keep falling—they start lower and adjust over time.

- Rate Lock vs. Float: If rates are trending down, floating might save more, but locking in provides certainty. Our loan officers can help decide.

As our CEO often says, “In a changing market, knowledge is your best asset. At Metropolitan Mortgage, we’re committed to turning Fed decisions into real wins for our clients.” Whether you’re a first-time buyer or looking to refinance, we offer competitive rates, quick approvals, and personalized consultations to fit your needs.

Conclusion

The Federal Reserve’s September 2025 rate cut is a welcome signal for the economy and the housing market, paving the way for more affordable mortgages and increased activity. If you’ve been on the fence about buying a home or refinancing, this could be your cue to move forward.

Don’t miss out—contact Metropolitan Mortgage today for a free quote or to discuss your options. Our experts are ready to help you make the most of this opportunity. Visit our website or give us a call to get started!