If you're wondering, "Are mortgage rates going down in Kansas City?" you're not alone. As…

Refinancing Your Home Loan: The Ultimate Guide in 2025

As we navigate the economic landscape of 2025, many homeowners are turning their attention to refinancing their home loans. With interest rates fluctuating due to Federal Reserve policies and market dynamics, refinancing can be a powerful tool to optimize your finances. But what exactly does it mean to refinance a home loan? In simple terms, refinancing involves replacing your existing mortgage with a new one, often to secure better terms, lower payments, or access equity. This process isn’t just about chasing lower rates—it’s a strategic decision that can impact your long-term financial health.

In this comprehensive guide, we’ll explore everything you need to know about refinancing your home loan. From current rates and benefits to the steps involved, types of refinances, costs, and pros and cons, we’ll equip you with the knowledge to decide if it’s right for you. Whether you’re a first-time refinancer or looking to capitalize on 2025’s market conditions, let’s dive in.

Current Refinance Rates in November 2025

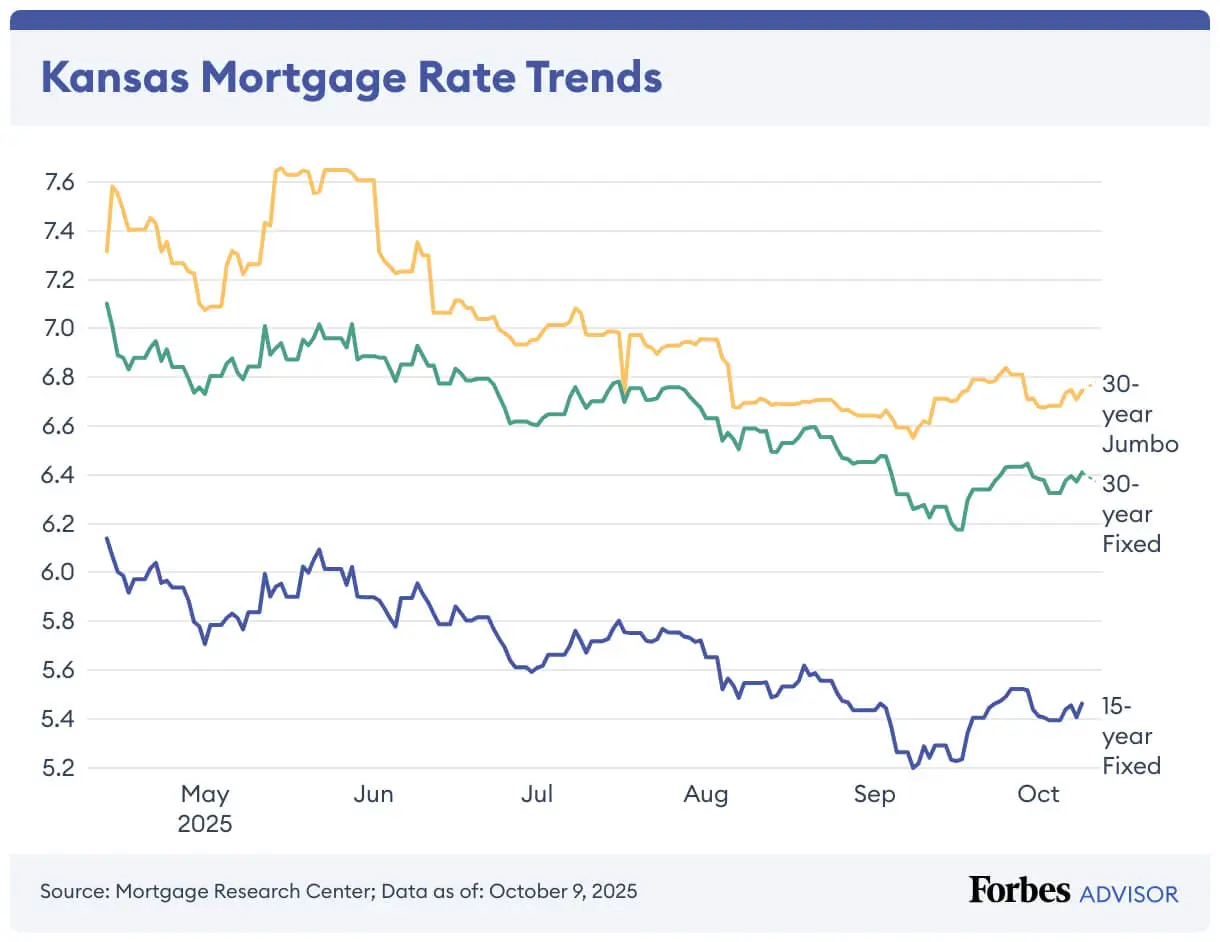

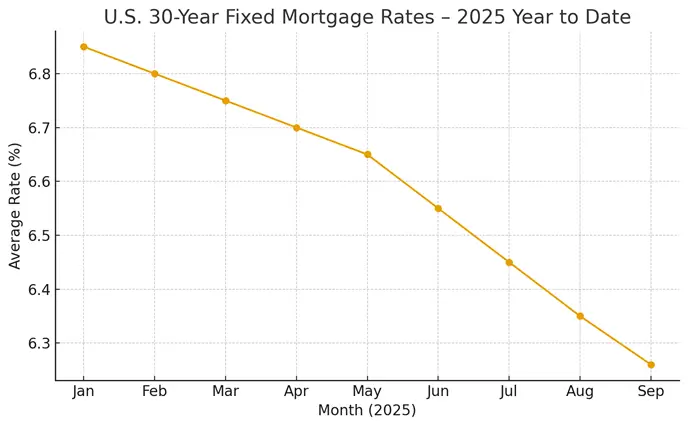

Interest rates are a key driver for refinancing decisions. As of November 15, 2025, the national average 30-year fixed refinance rate hovers around 6.66% APR, while the 15-year fixed is at 6.05% APR. According to Freddie Mac, rates for 30-year fixed mortgages remained relatively flat this week at about 6.24%, with some slight upward pressure from economic indicators. Other sources report averages between 6.13% and 6.95%, depending on the lender and borrower qualifications.

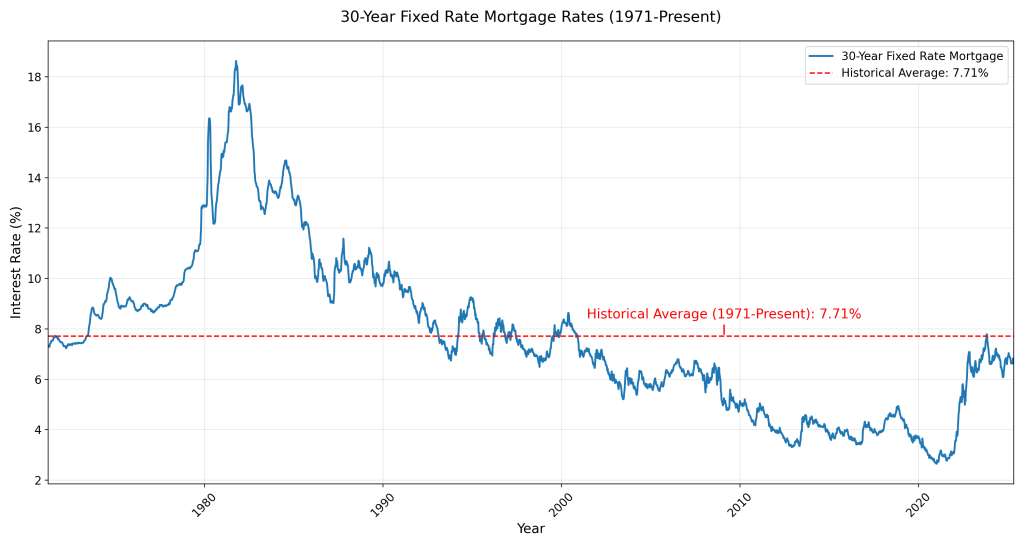

These rates represent a stabilization after earlier volatility in 2025, influenced by Fed rate cuts and inflation trends. For context, historical data shows that rates have been above the long-term average of 7.71% in recent years but are trending downward compared to peaks in 2024. If your current rate is above 7%, now could be an opportune time to explore options.

Mortgage Rate History | Chart & Trends Over Time 2025

Benefits of Refinancing Your Home Loan

Refinancing offers several advantages that can enhance your financial stability. One primary benefit is lowering your interest rate, which can reduce monthly payments and save thousands over the loan’s life. For instance, dropping from a 7.5% to a 6.5% rate on a $300,000 loan could save around $232 per month. This frees up cash for other priorities like retirement savings or home improvements.

Another key perk is changing your loan term. Shortening it to 15 years accelerates payoff and minimizes total interest, while extending it lowers monthly obligations for better cash flow. Refinancing also allows switching from an adjustable-rate mortgage (ARM) to a fixed-rate for predictability, especially in uncertain economic times.

Accessing home equity through cash-out refinancing is popular, providing funds for debt consolidation, renovations, or investments at potentially lower rates than credit cards or personal loans. Additionally, it can improve your debt-to-income ratio by consolidating high-interest debts, boosting your credit score over time. Overall, these benefits make refinancing a smart move for many in 2025’s evolving market.

Use our refinance calculator to see if refinance make sense for you.

When Should You Refinance in 2025?

Timing is crucial. Experts suggest refinancing when rates are at least 0.5% to 1% lower than your current one, ensuring savings outweigh costs. In 2025, with rates stabilizing around 6-7%, homeowners locked into higher 2023-2024 rates may find opportunities, especially post-Fed cuts.

Consider your break-even point: Divide closing costs by monthly savings to see how long it takes to recoup expenses—aim for 1-2 years. If you plan to stay in your home long-term, it’s ideal. However, if rates might drop further, waiting could pay off, though predicting markets is tricky. Also, check eligibility: Most loans allow refinancing immediately, but some require 6-12 months of payments. For many, 2025’s projected gradual decline makes now a viable window.

Types of Home Loan Refinances

There are several refinance options tailored to different needs. The most common is the rate-and-term refinance, which adjusts your interest rate or term without cashing out equity. Cash-out refinances let you borrow against equity for lump sums, ideal for home upgrades or debt payoff.

Streamline refinances, available for FHA, VA, or USDA loans, simplify the process with less paperwork and no appraisal. Cash-in refinances involve paying down principal to lower rates or eliminate PMI. No-closing-cost options roll fees into the loan, while short refinances help underwater mortgages. Reverse mortgages suit seniors tapping equity without monthly payments. Choose based on your goals—consult a lender for personalization.

Steps to Refinance Your Home Loan

Refinancing follows a structured process. Start by setting goals: Lower payments? Shorten term? Access cash? Next, check your credit score—aim for 740+ for best rates—and gather documents like pay stubs, tax returns, and bank statements.

Shop around: Compare rates from multiple lenders, including banks like Bank of America or credit unions. Submit applications, then undergo underwriting, which includes a home appraisal (unless streamlined). Review the loan estimate for terms and fees.

Finally, close the loan: Sign documents, pay closing costs, and start your new payments. The timeline typically spans 30-45 days. Be prepared for potential delays in busy markets.

Costs of Refinancing

Expect to pay 1-1.5% of your loan amount in closing costs, including origination fees (0.25-.5%), appraisal ($555), and title insurance. For a $300,000 loan, that’s $3,000-$4,500. Some lenders offer no-closing-cost refinances, but they may increase your rate.

In 2025, with rates at current levels, factor in prepaid interest and escrow setup. Weigh these against savings to ensure viability.

Pros and Cons of Refinancing

Pros include lower rates and payments, equity access, and term adjustments for faster payoff. It can also switch loan types for stability.

Cons: High closing costs, temporary credit score dips from inquiries, and extended terms increasing total interest. If you move soon, savings may not materialize. Cash-out increases debt, risking equity loss.

Conclusion

Refinancing your home loan in 2025 can be a game-changer if aligned with your goals and market conditions. With rates around 6.5-7%, many stand to benefit, but crunch the numbers carefully. Consult professionals to tailor advice to your situation. If done right, it could lead to significant savings and financial flexibility. Ready to explore? Start by checking your credit and shopping rates today.