Whether you’re an experienced homebuyer, first-time homebuyer or looking to refinance your existing mortgage, our team of mortgage lenders is here to help you navigate the process smoothly and efficiently. With a wide range of mortgage loan products and competitive rates, we’ll work closely with you to find the perfect mortgage solution that fits your unique needs and goals. Trust Metropolitan Mortgage to make your homeownership dreams a reality.

Metropolitan Mortgage: Your Trusted Overland Park Mortgage Lenders

Conveniently situated in the heart of Overland Park, our office serves as a welcoming hub for all your mortgage needs. Located amidst the vibrant energy of this bustling city within the Kansas City metropolitan area, our Overland Park office is easily accessible, ensuring that our clients have convenient access to expert guidance and personalized service.

Nestled in a community renowned for its well-planned neighborhoods and thriving business landscape, our office embodies the spirit of professionalism and dedication to serving the local real estate community.

Whether you’re stopping by to discuss your mortgage options, meet with one of our experienced mortgage agents, or simply inquire about our services, our Overland Park office is committed to providing you with a warm and inviting atmosphere where your homeownership aspirations can flourish.

Today’s Featured Mortgage Rates

Metropolitan Mortgage Corporation truly grasps the significance of securing the most favorable mortgage rates for your home purchase. Our commitment lies in providing highly competitive rates crafted to align with your individual requirements. Embark on a journey through our up-to-the-minute mortgage rates and uncover the perfect fit for you. – see mortgage rates.

Rates above may change at lender discretion and may not be available at the time of loan commitment or lock-in.

Purchase a Home in Overland Park

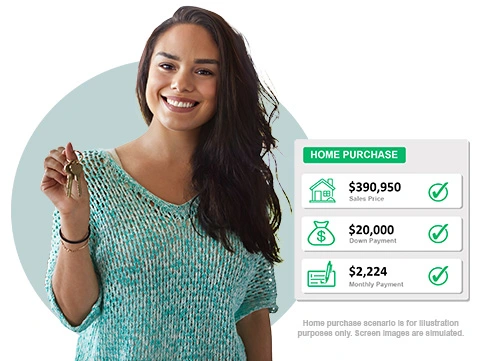

Embarking on the home buying journey with Metropolitan Mortgage is a seamless and personalized experience. As a trusted Overland park mortgage company, Metropolitan Mortgage offers comprehensive guidance and support to help you navigate every step of the home purchase process with confidence. Whether you’re a first time home buyer or a seasoned homeowner, our expert team is dedicated to understanding your unique financial goals and needs.

From pre-qualification to closing, Metropolitan Mortgage provides tailored solutions, competitive rates, and transparent communication, ensuring a smooth and stress-free home buyers journey. With Metropolitan Mortgage, you can take the first step towards your dream home with assurance and peace of mind. Get started on your pre-approval letter and we can send to your real estate agent today.

Refinance a Home in Overland Park, KS

Beginning the refinance process with Metropolitan Mortgage is a straightforward and customer-focused endeavor. As a reputable overland park mortgage lenders, Metropolitan Mortgage offers personalized assistance and expert advice to guide you through each phase of refinancing your home loan.

Whether you’re looking to lower your interest rate, shorten your loan term, or tap into your real estate equity, our dedicated mortgage consultant are committed to understanding your specific financial objectives. Metropolitan Mortgage provides transparent information, competitive rates, and efficient processing, ensuring a streamlined refinance experience. From initial consultation to final closing, you can trust

Metropolitan Mortgage to help you navigate the refinance process with ease and confidence, putting you on the path towards greater financial stability and homeownership success.

Discover the Range of Loan Options at Metropolitan Mortgage

Discover an array of loan programs that cater to diverse financial situations and goals. Whether you are a first-time or experienced homebuyer, our loan options are designed to fit your individual requirements.

We offer a wide range of options to suit everyone. We offer a variety of loan options. Conventional loans (fannie mae) offer stability, while government-backed programs, like the Federal Housing Administration (FHA) which offer additional benefits, or our renovation loans. Our team is dedicated to providing transparent explanations and personalized advice. This empowers you to select the loan program that aligns perfectly with your unique requirements.

We have unmatched expertise and dedication to customer satisfaction. You can be sure that you will make wise decisions during your home loan process. Unveil our comprehensive range of loan programs and explore the possibilities that await you.

Why Choose Metropolitan Mortgage?

Metropolitan Mortgage for all your mortgage needs. Our seasoned home lenders bring extensive expertise and professionalism to the table, guaranteeing optimal loan solutions. With our competitive rates and top-notch service, we are dedicated to assisting you in reaching your homeownership, refinancing, or financing objectives. Place your trust in Metropolitan Mortgage, a reputable financial institution and equal housing lender serving Kansas and Missouri.

FAQ – Frequently Asked Questions

When selecting a mortgage lender in Overland Park, KS, what factors should I consider?

When choosing a mortgage lender in Overland Park, KS, it’s essential to weigh factors such as interest rates, fees, and closing costs. Seek out reputable lenders with favorable customer service ratings. Find a home mortgage lender who provides loan options tailored to your financial situation and goals. Comparing offerings from multiple lenders can help secure the most advantageous deal.

How long does the mortgage application process typically take with lenders in Overland Park, KS?

The timeframe for the mortgage application process in Overland Park, KS can vary based on individual circumstances and the lender’s procedures. Generally, it takes approximately 30-60 days on average. However, this duration can be influenced by factors such as credit score, income verification, and property appraisal. Collaborating with a reputable Overland Park mortgage brokers can expedite the application process.

What documents will I need to provide when applying for a mortgage in Overland Park, KS?

To apply for a mortgage in Overland Park, KS, you’ll typically need to furnish personal identification such as a driver’s license or passport. Additionally, proof of income like pay stubs or tax returns, along with documents pertaining to assets and debts such as bank statements and credit reports, will be required. Depending on your specific financial situation, additional documentation may be necessary. You can apply via internet by clicking here or by calling telephone number (913) 642-8300.

Conclusion

In summary, navigating the mortgage lending landscape in Overland Park, KS can be overwhelming, but Metropolitan Mortgage is here to simplify the journey. With our extensive expertise, professionalism, and dedication to customer satisfaction, we aim to provide you with the best loan options tailored to your needs. Whether you’re seeking purchasing loans, refinancing loans, or specialized options like rehab or investment property loans, we’ve got you covered.

Our mission is to turn your homeownership dreams into reality by offering low down payment options and first-time homebuyer loans. Don’t hesitate any longer—begin your mortgage journey with Metropolitan Mortgage today, and let us guide you every step of the way. Reach out to us now to discover the perfect mortgage option for you.

Serving Nearby Cities:

Gardner, KS | Lawrence, KS | Leawood, KS | Lenexa, KS | Olathe, KS | Shawnee, KS | Topeka, KS