Mortgage Rates

We offer competitive mortgage rates to make your Overland Park home financing affordable. Whether you’re buying a new house or refinancing an existing mortgage, our rates fit your budget. Furthermore, contact us today to learn more about our current rates and find the best option for you. By doing so, you can take advantage of our low rates and save money over the life of your loan – see rates.

Terms above may change at lender discretion and may not be available at the time of loan commitment or lock-in.

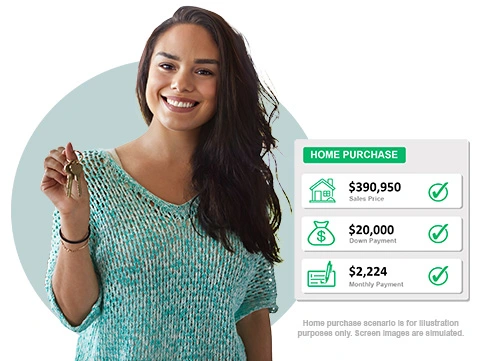

Home Purchase Loans

As local mortgage lenders, we provide various loan options to suit different needs. For instance, if you’re a first time home buyer, we have special programs to make buying your first house easier and more affordable. Specifically, they include:

Fixed Rate Mortgages

Enjoy steady monthly payments with our fixed rate mortgage loan. With this option, you can plan your finances with confidence, knowing your payment will not change.

Adjustable Rate Mortgages

Benefit from lower initial rates with our adjustable rate loan options. Consequently, this type of financing can be ideal if you plan to move or refinance in a few years.

First Time Homebuyer Programs

Access special programs to make buying your first home in Overland Park easier and more affordable. We offer guidance and support to help you navigate the process and secure the best terms. Additionally, we help you understand the differences between these options and choose the one that best fits your situation.

Refinancing Options

Refinancing can help you save money or pay off your mortgage faster. Consequently, at Metropolitan Mortgage, we offer several refinancing options, including:

Rate and Term Refinance

Lower your interest rate or change your loan term. By doing so, you can reduce your monthly payments or pay off your mortgage sooner.

Cash-Out Refinance

Access the equity in your home for other financial needs. Metropolitan Mortgage allows you to take out more than you owe on your current loan and use the extra cash for things like improvements, payoff credit cards or debt consolidation.

Streamline Refinance

Simple refinancing for eligible home owners. This type of refinance requires less paperwork and can be completed more quickly than a traditional refinance. These options meet a variety of needs, whether you want to reduce your interest rate, shorten your loan term, or access your home equity.

Loan Programs

We offer many loan programs to meet different needs, provided by experienced mortgage lenders:

VA Home Loans

Special advantages for veterans and active duty military personnel. VA loans often require no down payment and offer favorable terms.

FHA Loans

FHA (federal housing administration) offers lower down payment options with flexible credit requirements. This type of loan is great for first time home buyers or those with less than perfect credit.

Jumbo

Larger loan amounts for high value properties in Overland Park. If you need a loan that exceeds the conventional loan limits, a jumbo loan might be right for you.

Conventional

We offer standard loan options with competitive terms. Furthermore, these loans can be used for primary residences, second homes, or investment properties. Ultimately, each of these programs helps you find the financing that best fits your needs and goals.

Frequently Asked Questions (FAQs)

What documents do mortgage lenders in Overland Park need for a mortgage application?

Common documents include proof of income, credit reports, and asset statements. Additionally, our team guides you through the specifics to ensure you have everything you need.

How long does the pre approval process take mortgage lenders in overland park ks?

Usually, the process takes 30-45 days, but it can vary depending on individual circumstances. We strive to make the process as smooth and quick as possible.

Can I get pre approved for a mortgage?

Yes, we offer pre approval to help you understand your budget and streamline your home search. Getting pre approved can give you a competitive edge when making an offer on real estate.

What is the difference between a fixed and an adjustable rate mortgage in Overland Park?

A fixed term has a consistent monthly payment, while an adjustable mortgage has an interest rate that can change over time. We help you determine which option is best for you.

Overland Park Mortgage Lenders – Get Started Today!

Ready to start your home ownership journey with trusted mortgage lenders? Therefore, contact us today to schedule a consultation. Our friendly team is eager to assist you. You can reach us at (913) 642-8300 or visit our Overland Park office for personal service. Additionally, you can schedule a meeting online – link.

Connect With our Overland Park Office

Stay updated with the latest news and tips by following us on social media. Moreover, for more information about our services, visit our Google My Business page. We look forward to helping you achieve your home ownership goals.

Call to Action

Don’t wait any longer to secure your dream home! Therefore, call us now at (913) 642-8300 or click here to schedule your free consultation. Moreover, let Metropolitan Mortgage help you find the perfect home loan solution today.

Google Map

Find us easily with our location on Google Maps. Visit our Overland Park office for personal help.

Metropolitan Mortgage Corporation – Overland Park, KS

Serving Nearby Cities:

Gardner, KS | Lawrence, KS | Leawood, KS | Lenexa, KS | Olathe, KS | Shawnee, KS | Topeka, KS